Introduction

Asean Economic Community (AEC) 2015 has become important opportunities for Small and Medium enterprises (SMEs) in Indonesia to expand. It is expected that the Asean Economic Community (AEC) 2015 which has been started is able to promote the development of economics in Indonesia, especially the effort to enhance industrial competitiveness in the international market (Pratono and Mahmood 2015). In addition, SMEs have provided roles together with large manufactures to supply the human resources and opportunities to enable country’s economic growth (Tambunan 2000).

SMEs require business relation development to emerge in international market (Zohdi et al. 2013; Roy 2012; Hormiga et al. 2011; Fazli et al. 2013; Daou et al. 2013; Agndal and Chetty 2007; Abiola 2013). Roy (2012), asserts the importance of SMEs to conduct cooperation and method of business network and eventually to enhance business performance. Agndal and Chetty (2007b) explain the importance of social relations amongst SMEs to anticipate the changes and the dynamic of market condition. Ronning (2011) investigates the relationship between social capital and new business start-ups. The research shows that farming experience and part-time education diminish the positive associations found between social capital variables and entrepreneurial activity.

The ability of SMEs in developing business relations is an important resource to achieve performance in international market. Previous studies have discovered the evidence that business network and customer orientation are important factors to enhance the business performance (Taghieh et al. 2013; Roy 2012; Raza 2012; Mu et al. 2008; Mitrega 2012). Another study shows that relational capability is a key factors to create customer value and innovation, which eventually will achieve business performance (Ngugi et al. 2010; Aryanto, 2017). Furthermore, the other empirical evidence shows that the relational quality with its customers as the driving factor for business performance (Mitrega 2012). Barney (1991) explains that it is important for the organizations to build their internal capability to achieve competitive advantage. Moreover, Barney (1991) asserts that companies will be the future orientation, which is resulted by their strategic resources. Yeniyurt et al. (2005) asserts the role and the importance of organizations on global market entry. Furthermore, the organization has its competence in knowledge and resources in order to develop about customer’s knowledge, competitors, and suppliers through coordination and supply chains.

The impact of relational capabilities on business performance is being debated by other research. Other research investigates the relational capabilities do not affect on business performance. Moen et al. (2008) explain that the ability to build business relationship through the use of technological information has a negative effect on satisfaction and knowledge in developing new market. Other research found out that inter-firm co-operations have a negative effect on business performance (James G Combs and Jr 1999).

Market knowledge competence can enhance on business performance (Hughes et al. 2008). According to Kohli and J. Jaworski (1990), the importance of market knowledge role in marketing function through formulation strategy and implementation, and they suggest that organization should get information about the competitors and use it in a coordinated department to use strategy, understanding, creation, selection, implementation, and strategy modification. Hou and Chien (2010b) explains that market knowledge has become the dominant asset of global organizations and the key factor to manage competitiveness. Frank et al. (2012) investigate the effect of market orientation in a specific organizational context, namely family firms. The research shows that market orientation has a positive effect on success with new products/services and share of regular customer’s but not with sales growth.

The aim of this study is to investigate the mediating effect of value creation on the relationship between relational capabilities to business performance. Especially, this research contribution is focused on how the contribution of value creation is able to explain the correlation on business performance to have different results as compared to the previous studies.

Literature review

Business Performance

Lin and Peng (2008) explains that business performance is the result of organization operational activity, including the achievement of organizations goal either internal or external achieve. Furthermore, Lin and Peng (2008) define business performance as the achievement of organization’s goal related to sales growth, profit and market share. Kaplan and Norton (1992) suggest a structure to measure business performance based on four perspectives: financial, customer size, business internal size, and innovative learning. According to Olson and Slater (2002), performances is defined as a company evaluation from effectively perspective. Furthermore, Olson and Slater (2002) asserts that performance measurement is visible on the success of new products which the percentage of sales resulting from new product sale or new customers, market development, and sales or market share growth, characteristics from innovation and learning perspectives.

Sin et al. (2006) explain that business performance is measured from seven aspects, those are: sales growth, customer’s retention, return on investment (ROI), market share, trust, customer’s satisfaction, and return on sales (ROS). Moreover, Sharabati et al. (2010) measure business performance using the dimensions of productivity, profitability and market assessment. Najib and Kiminami (2011) measure business performance with three indicators, those are: sales volume, profitability and market share.

Jaakkola et al. (2010) state that business performance is the merger of both financial performance and market performance. The business performance term is used as an effort to develop performance in order to describe market aspect and financial performance aspect. Business performance refers to financial performance and financial steps, such as profit margin and return of investment, while market performance is the steps such as market share and sales volume that have been achieved. Another study which was conducted by Kara et al. (2005) measures business performance using three dimensions, namely: profit achievement, sales achievement and ROI achievement. According to Sin et al. (2002), business performance is measured using the indicators such as sales growth, customer retention, market share, ROI and overall performance. A study conducted by Nwokah and Maclayton (2006) measured business performance using the indicators of sales growth, company profit and market share owned by the company. Business performance in this study was measured using four indicators, namely sales volume, sales value, accumulation of numbers of products sold, and scope of served market.

Value Creation

Porter (1985) develops a framework of value chains which is known as Porter analysis in creating value in organizations category. Moreover, Porter (1985) conducted value chains analysis by studying company activities which have direct effect to the value creation, and supporting activities so that they affect the value and eventually will affect performance. Tsai and Ghoshal (1998) explain that organization needs to create new product and unique products, needs to specific its product and reallocate resources, to combine new resources, and combine existing resources in new market.

According to O’Cass and Sok (2013), it emphasizes that value creation concept in a organization is a determinant variable of company’s innovation activity. Moreover, managers and employees have important roles in creating the value. The result of the study showed that innovation capability has positive effect in the organization ability to bargain value, and eventually will affect on the performance.

While Clarke and Fuller (2011) tested the role of multi-organization Cross Sector Social Partnership (CSSP), which focusing on strategic collaborative management on performance. Some researchers state that value creation is the main key to generate product innovation which eventually affect the enhancement of business performance (Viljakainen and Toivonen 2014; Sørensen and Jensen 2015; Lefaix-Durand et al. 2005; Gurau 2004). According to Gurau (2004) explains that value creation concept is closely related with internal activities in creating of value for the customers. The organization internal activities include design, product, market, delivery and other activities which support the creation of a product.

Another study conducted by Lefaix-Durand et al. (2005) explain the inter-firm relationship model and value creation. The value creation process model can be established through cooperative process in the internal business. Inter-firm relationship is a new trend in the present business environment, trends such as market orientation, time based competition, supply-chain management, strategic partnership on business. Banyte and Dovaliene (2014a) investigate the correlations between customer engagement into value creation and customer loyalty. Moreover, the result showed that relationship between customer engagement into value creation and customer loyalty are analyzed in an integrated manner, i.e. through direct and indirect relationship between the two constructs.

Relational capabilities

Relational capabilities have been discussed in many different contexts. In many studies, relational capabilities is defined an importance asset and organizational internal capabilities perspective (Zohdi et al. 2013; Ngugi et al. 2010; Hormiga et al. 2011; Fazli et al. 2013). Relational capabilities is strongly related with the focus on knowledge access acceleration, supporting innovation and creating competitive advantage (Smirnova et al. 2011). Moreover, relational capabilities involve business exchange and effort to gain information’s and business specific relation through the integration of other knowledge.

Referring to previous study, relational capabilities is defined as a organization ability to communicate, coordinate and manage business interaction (Day and Van den Bulte 2002). Furthermore, the study explains that relational aspect is an internal capability which is still interesting to study. Study conducted by Dyer and Singh (1998), and Jacob (2006) develop the concept of relational capabilities in three dimensions, i.e. the ability in configuration process, the ability to communicate with customers, and the ability to control the business process.

The study about relational capabilities also provides an interesting issue in the context of business interaction. Previous study done by Ayios (2004) has focused on relational capabilities in the understanding of organization behavior and the role of business culture in business relation model practices. It is strengthened that inter organizational relations is very important process. However, Butler and Purchase (2008) emphasizes that an effort to create trust is not merely between the organization but also on higher level of trust in interpersonal organizational.

In Resource Based View (RBV), internal capability determines the roots of sustainable competitive advantage of an organization (Barney 1991). The example of internal capability include patent right protected under law, knowledge of technology, production skill which is difficult to imitate by the competitors (Lee et al. 2001). Those capabilities have been implemented in many technology support (Moen et al. 2008; Lin and Chen 2007; Ismail and Mamat 2012; Mohannak 2007). According to Dakhli and De Clercq (2004) explain the effect of two kinds of capital in relational capabilities, namely human capital and social capital in organizational value creation in the model of innovation. The study uses previous conceptualization of social capital which consists of trust, member of association, and behavior norms to investigate the correlation between social capital indicators and innovation. The relational capability in this study is an effort conducted by SMEs furniture’s export oriented to develop relationship with the buyers/customers in international market.

Market Knowledge Competence

Knowledge-based view considers that knowledge is one of the most important assets to create business competitive advantage (Tayauova 2012; Hou and Chien 2010a; Hughes et al. 2008; Li 2013). Market knowledge competence is mostly used by organization to develop and expand resource capability of the organizations (Barney 1991). Knowledge is defined as a belief which is based on information and considered as the form of high information value in which prepared for decision making process and implementation process (C.K. Prahalad and Hamel 1994). Jorgensen and Nilsen (2015) explain how small and medium-sized enterprises (SMEs) develop their patterns of internationalization after taking their first steps in a foreign country. Moreover, SMEs need to identify and describe types of development patterns in international SMEs. The dynamics environment of an organization demands the organization to consider knowledge as wealth so that it is affected the effort to gain competitive advantage. That condition demands the manager to build organization culture that encourage the creation, dissemination, sharing and utilization of knowledge to achieve superior business performance (Boumarafi and Jabnoun 2008). Various types of research have tested the issues related to creation, development, codification, storage, distribution, sharing, and utilization of knowledge (Zaim et al. 2013). In order to achieve competitive advantage in the market, and to achieve superior business performance, the organization has to identify, search, develop, maintain, and contribute its competencies.

Market knowledge competence has been admitted as the source of competitive advantage and described as a core competence (C.K. Prahalad and Hamel 1994), unique knowledge (Day 1994), superior resources (Morgan and Hunt 1994), and strategic assets (Barney 1991). However, other study investigates the role of market knowledge can be conducted through strategy framework and implementation, and suggested that organizations have to gain information about competitors in order to use the strategy, understanding, creation, selection, implementation and strategy modification that will be implementated by the organization (Kohli and J. Jaworski 1990; Slater and Narver 1994).

Day (1994) states that competency is considered as skill and business organizational collective learning of which are used in the business activities process. According to Pitt and Clarke (1999) considers competence as coordinated organization ability, collective skills and capacity from the organizations. In a competitive external environment, an organization needs to learn continuously about new market trend and advanced ideas (Hoe 2008). Knowledge is something expensive which becomes advantage comparison among competitions (Hunt and Morgan 1995). However, according to Hou and Chien (2010b), market knowledge has become the biggest asset of an organization and the key to maintain organizational competitiveness. To enable an organization to have an ability to compete effectively, the company has to give the knowledge its own and creating their new market knowledge in choosing and maintaining the market. This research measures market knowledge competence indicators which consist of market information search, fulfillment of market demand, approach to achieve market. Those indicators are the reflection of market knowledge competence.

Hypotheses development and empirical research model

The Relationship between Relational Capabilities and Business Performance

Smirnova et al. (2011) conducted the study on the correlation between market orientation on the development of relational capabilities and performance in which the findings showed that market orientation with customer’s orientation dimension has positive effect in relational capabilities. Relational capability affected on business performance. A study conducted by Lee et al. (2001) found the correlation between internal capability and external network on business performance. The result of regression model showed that the three dimensions of internal capability affected innovation performance. The interactions among internal capabilities based on partnership relations have significant effect on performance.

Hormiga et al. (2011) asserts relational partnership with customers, relational partnership with suppliers, company’s informal network and company reputation have positive effect on the success of company performance. Similar research was also conducted by Borchert and Bruhn (2010) which conclude that human capital, relational capital, team performance and size of organizational team affected on the business which is measured by business performance.

Kansikas and Murphy (2011) investigate the effect of family social capital on financial firm performance. The results suggest that family social capital has both a direct and indirect positive influence on family firm financial performance. Sousa et al. (2011) test the role of entrepreneurs’ social networks in the creation and early development of biotechnology companies. The research shows that the important and understanding on the process of network building and network mobilization, as well as on the contribution of different types of networks to the entrepreneurial process.

Wegner and Koetz (2016) explain how network governance can enhance the performance of the participating members, and that the size of the network is relevant to the choice of the most appropriate governance. Kuntaric et al. (2012) explain the performance is significantly influenced by the approval of the personal network, representing the cognitive dimension of social capital. Barbat et al. (2014) explain and find that if networking indeed leads to a more rapid export process, the levels of export activity remain modest and some firms even stop exporting.

Based on literature review and previous studies, it is proposed that:

H1: the stronger relational capabilities, the higher business performance for the SMEs

The Relationship between Market Knowledge Competence and business Performance

Kohli and J. Jaworski (1990) define market orientation from market intelligence perspective which includes generation intelligence, intelligence dissemination and comprehension. The study done by Narver and Slater (1990) consider that market orientation is as an aspect of organization culture. They measure market orientation on the level of behavior and define orientation using customer, competitor orientation, and inter-functional coordination. Those two different approaches are combined in a market knowledge framework in accordance with the focus of information process, customers and competitors. Stoian et al. (2012) explain the importance of international marketing strategy to achieve export performance. Moreover, overall international marketing strategy influences the export performance in SMEs, taking into account the moderating effect of internal and external variables.

Howden and Pressey (2008) explain that the effort to understand customer value resources related to buyer-supplier relationship is considers as priority scale and the key component for the organizational long-term advantage. Weng and Huang (2012) tested the effect of the ability to integrated customer knowledge, the ability of customer knowledge creation, and the ability in developing customers relationship on the performance development of new service. The result of empirical study of Weng and Huang (2012) showed the ability to absorb customers knowledge has positive correlation with performance development of new service, and the ability to integrated customers knowledge completely mediates the relationship between the ability to absorb customer knowledge on the development of performance development of new service. Arpa et al. (2012) investigate how entrepreneurial orientation, market orientation and internationalization in born global small and micro-businesses. The research shows that combine internationalization and orientation approaches in studying small and micro-businesses.

Based on literature review and previous studies, it is proposed that:

H2: the higher Market knowledge competence, the higher business performance for the SMEs

The Relationship between Relational Capabilities and Value Creation

Relational capabilities also affect on the product value creation what customers desire through business network (Zohdi et al. 2013; Ngugi et al. 2010; Lee et al. 2001; Fazli et al. 2013; Elango and Pattnaik 2007). Relational capabilities according to the study conducted by Ngugi et al. (2010) can be created in model of human relational capability, technological relational capability, managerial systems relational capability, and cultural relational capability. According to Lamprinopoulou and Tregear (2011) found the horizontal relations between SMEs producers on market performance. Relational capability is an important part of social asset (Tjahjono 2011). Furthermore, Tjahjono (2011), It‘s study found the importance of social asset in enhancing individual satisfaction which eventually increase the organization performance. Similar research conducted by Ural (2009), showed that there was positive effect of sharing information on the financial export performance and the satisfaction with export business; long term orientation on financial export performance, export performance and the satisfaction with export business; and the correlation of satisfaction with financial performance, strategic performance and satisfaction with export business.

A study conducted by Zohdi et al. (2013) explains that need and customer demand on the organization is always changing and to understand the changes is important for the business performance. Furthermore, the condition and regulation changes that influence the market including technology changes also affect on the effectively of organizational success in the market. Other study conducted by Lawson-Body and O’Keefe (2006) found out that inter-organizational based on information system can contributes strategic benefit through customer loyalty creation. Based on literature review and previous studies, it is proposed that:

H3: the stronger relational capabilities, the higher value creation for the SMEs

The Relationship between Market Knowledge Competence and Value Creation

Jayachandran et al. (2004) measured market knowledge process to the customers using customer response capability. The concept and marketing method offer potential relationship and beneficial to understand, explain and manage networking (Cravens and Piercy 1994). Collaborative relations among the members of the network and the relation with the last customer is one of the implementation of market relations. Chaston (2000) concluded that a high organizational growth will tend to encourage an organization to participate in the business network.

A membership of a network has potential to achieve the performance in the organizational level. Furthermore, the study also found that a high organizational competence affects the orientation on business network. Mort and Weerawardena (2006) stated that the organization basic ability in developing business network needs to be identified. Network capability enables identification and exploitation of market share; facilitate the development of product knowledge intensity and the organizational ability to achieve international market and business performance in global market. Moreover, Mort and Weerawardena (2006) emphasize the network that is not flexible is also important for the continuance of the organization.

Based on literature review and previous studies, it is proposed that:

H4: the higher market knowledge competence, the higher value creation for the SMEs

The Relationship between Value Creation and Business Performance

O’Cass and Sok (2013) explain that innovation capability underlies the value creation ability, management style, employee’s behavior and marketing supports innovation capability. Wu and Choi (2004) tested the reciprocity role of managerial values on the improvement of competition and business performance through trust and network ties. The result showed that reciprocal relationship from managerial values has significant correlation with trust. Managerial values have significant correlation with network ties.

According to Guenzi and Troilo (2006), organizations ability in creating value can be shaped from the organization capability in marketing activities process. The result of the study concluded that an organization that conducts market orientation, and has the ability to lead the market give strong effect on the superior performance.

Based on literature review and previous studies, it is proposed that:

H5: the higher value creation, the higher business performance for the SMEs

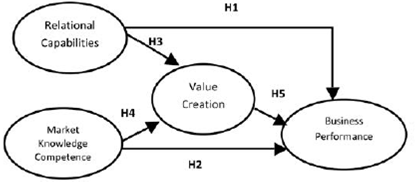

The research framework is shown in Figure 1

Figure 1 Mediating Effect of Value Creation in the Relationship between Relational Capabilities on Business Performance

The aim of this study is to explain the effect of relational capabilities, market knowledge competence, and value creation on business performance, especially of SMEs furniture export oriented. Based on literature reviews and previous studies, the research framework is constructed based on Resources Based View (RBV) approach developed by (Barney 1991). This study explains how SMEs furniture export oriented are able to achieve superior business performance. The researcher understands the role of value creation variable as the mediation variable which is originated from organization resource capability that it is able to achieve superior business performance.

Methodology

Research Framework

The objects of this study were the entrepreneurs of SMEs furniture industry export oriented in Central Java who develop inter-organizational relationship pattern with the buyers in international market. The analysis unit in this study are the owners or managers, either production or marketing manager. The SMEs furniture industry export oriented managers can represent the views, attitudes, behaviors in conducting relational capabilities and market knowledge competence in the development of value creation to gain higher business performance.

Variable Definitions and Measurement

To test the hypotheses model, a survey questionnaire was designed on the basis of comprehensive literature reviews to specify a set of items that ensured content validity. The self-administered questionnaire was part of a wider examination of relational capability, market knowledge competence, value creation and business performance. As suggested by Wright et al. (2006), the existing scales were adapted, modified, and extended. Because the study was conducted in Indonesia SMEs, the survey instrument was in Central Java. The face to face validity analysis of the questionnaire was tested in a try out with managers or owners of SMEs furniture industry oriented. Furthermore, face to face interviews with these managers or owner were conducted to check the information accuracy, validating the outcome of analysis and developing an understanding of questionnaire. The level of business performance implementation was measured as well. This research used self-reported questionnaires to measure relational capabilities, market knowledge competence, value creation and business performance.

Relational capabilities. According to Day and Van den Bulte (2002), relational capabilities is an organizational ability to communicate, coordinate and manage business interaction. All constructs of relational capabilities were measured with multiple and open-ended items scales. Most of the measurements were assessed via ten-point (1 - 10) item rating scales ranging from ‘strongly disagree’ to ‘strongly agree of four indicator: personal ties with buyers, information about the product quality with international standard, long-term relationship oriented, relationship on mutual benefits with customers.

Market knowledge competence. Market knowledge competence is a competence to satisfy the needs of customers through the effectiveness and response to achieve the sustainability for the success of the organization performance (Jayachandran et al. 2004). The subjects were asked to indicate, on a ten-point (1 - 10) rating scales ranging from ‘strongly disagree’ to ‘strongly agree of our indicator: market information, speed response to market condition, new entry market expansion and customer approach to market achievement.

Value creation. Value creation is a firms interpretation and response to customer requirements with the delivery of superior product in the value offering and the extent of perceived value customers receive (O’Cass and Sok 2013). As in previous studies on a ten-point (1 - 10) type rating scale used. The researcher developed based on four indicators namely value added of product quality, cost efficiency, product service assurance, and customer response.

Business performance. Business performance was the result of operational activities organization include the achieve of the internal and external outcomes (Lin and Peng 2008). The subjects were asked to indicate on a ten-point (1 - 10) rating scale, four indicators: sales volume, sales growth, profitability and market share.

The research data will be collected consist of primary data and secondary data. Primary data were collected using a survey method with most face to face interviews and questionnaires distribution. Questionnaire that was tested content validity and reliability then performed field trials in order to obtain improved consistency and validity of each instrument.

Research Sample

Data gathering was conducted through questionnaires face to face interviews and distribution. The number of total respondents were 305; they were the SMEs managers or owners to fill out the distributed questionnaires. Based on the survey, there were 209 questionnaires which are completely filled out with the level of percentage was 68.5 percent from the total respondents. This research uses four constructs, namely relational capabilities, market access competence, value creation and business performance. In addition, relational capabilities were the only one invalid construct validity. The number of questionnaires that did not meet the qualifications was 24 respondents. There were 209 questionnaires used in the study. However, during data processing, the extreme value was 37 questionnaires, so they were eliminated from the research sample. The total samples of the study were 172 respondents.

The data were gathered from SMEs furniture industry export oriented in seven regencies in Central Java. Those seven regions represented the regions that are the largest SMEs export oriented groups in Central Java based on the data assessed by Indonesia Furniture Association, 2014 (ASMINDO, 2014).

Data analysis and Measurement models

The hypotheses test in the study used SEM approach. SEM was used to test the causality relation between relational capabilities, market knowledge competence, value creation and business performance constructs. The test using SEM consists of two kinds of variables, i.e. observable/manifest variable; and latent/non-observable variables. Observable variabel is the indicator which is reflected from construct and latent variable is developed from a construct theory. In evaluating the fit of the model, several goodness-of-fit indices were used; those are normal fit index (NFI); comparative fit index (CFI); Tucker-Lewis index (TLI); root mean square error of approximation (RMSEA) in addition to the X2 statistic.

Table 1 explains the information about the difference of each construct and the question item used, the Cronbach value α on each construct, the loading value of each construct should be more than 0.6 cut off point (J. F Hair et al. 1998). The value of variance extracted (VE) is more than the determined critical value, which is 0.5. The test result of construct validity value, variance extract, and discriminant validity in table 1 shows that the result that the construct of relational capabilities, market knowledge competence, value creation and business performance discriminant validity (DV) are based on the determined statistics cut off value that is construct reliability (CR) was more than 0.7, the variance extract (VE) was more than 0.5, and discriminant validity (DV) was more than 0.7.

Results and Discussion

In order to test empirical research and the difference hypotheses against the structure model, covariance-based path estimation was used, namely structural equation modeling (SEM) based on the Maximum Likelihood Estimation. The overall fit measures showed a good fit of the model; CMIN/Degree of Freedom (X2) = 1.290 (p=0.038), GFI=0.928, AGFI=0.897, CFI=0.981, TLI=0.976, RMSEA=0.041.

In our study the value of CMIN/DF same as the value of chi-square statistics, X 2 divided by DF. Therefore, CMIN/DF as well as X 2 relatively is less than 2.0. It is an acceptable value, that indicates model and data fit. Based on the estimation of structural equation modeling (SEM), the value of CMIN/DF is 1.290. Therefore, the model is acceptable (Arbuckle, 1997).

Mean, standard deviation and correlation among the observed variables are illustrated in Table 2. With point rating scale from 1 for the lowest performance to 10 for greatest performance, the observed firms have moderate business performance at level 7.2006 of average, relational capabilities, at level 7.5698, market knowledge competence at level 7.6439, value creation at level 7.3205. All constructs also showed moderate level with average rate range at 7 rating scale.

Reliability test adopts quality criteria, in which the CR measurement showed that all variables have coefficient greater than 0.7. This result implies that all variables are accepted reliability. The measure of average variance extracted (VE) shows that all variables have greater number than 0.5. This result indicates that all variables are adequate discriminant validity (see Table 1). Figure 2 and Table 3 shows that the path analysis, which indicates that there is no significant relationship between relational capabilities and business performance, since the path-coefficient and probability. The result show t-table with sample greater than 100 shows that t-statistics for two tailed should be 1.96 for alpha 5%.

Table 2 Descriptive statistic and correlations

| Mean | Standard Deviation | 1 | 2 | 3 | 4 | |

| Relational Capabilities (RC) | 7.5698 | 0.69999 | 1.000 | |||

| Market Knowledge Competence (MNC) | 7.6439 | 0.81840 | 0.329** | 1.000 | ||

| Value Creation (VC) | 7.3205 | 0.70285 | 0.373** | 0.535** | 1.000 | |

| Business Performance (BP) | 7.2006 | 0.79271 | 0.327** | 0.552** | 0.590** | 1.000 |

**Correlation is significant at the p<0.01 level (2-tailed).

Table 3 Summary of results from the SEM Models

| Relationship | Path Coeff. | CR | Prob. | Hypotheses |

|---|---|---|---|---|

| Relational capabilities ® Business performance | 0.100 | 0.949 | 0.342 | Not Supported |

| Market Knowledge Competence ® Business Performance | 0.332 | 3.404 | 0.000 | Supported |

| Relational capabilities ® Value creation | 0.213 | 2.502 | 0.012 | Supported |

| Market Knowledge Competence ® Value creation | 0.356 | 4.886 | 0.000 | Supported |

| Value creation ® Business performance | 0.533 | 3.995 | 0.000 | Supported |

**P < 0.01; *P < 0.05

The empirical model illustrated in Figure 2 has five hypothesized relationship among the variables, namely relational capabilities, customer response capability, value creation and business performance. Figure 2 shows the path diagram resulting from the structural equation modeling analysis using AMOS software. The results show that all the measurements have significance loadings to their corresponding second-order construct.

This study provides empirical model that two is direct effect of relational capabilities and market knowledge competence on business performance. The previous studies support the result and argue that the significant relationships between market knowledge competence on business performance, but relational capabilities are insignificant. Another reason for insignificant relationship may come from statistical approaches, such as outweighed effect from other variables. Moreover, the role of mediating variable may explain the complex relationship between relational capabilities and business performance.

The results did not support hypotheses 1, which stated that impact of relational capabilities on business performance. The statistical result is insignificant of hypotheses 1(coefficient = 0.342, p>0.05).

Hypothesis 2 is supported, which indicates that positive impact of market knowledge competence on business performance.The statistical result is significant of hypotheses 2 (coefficient = 0.000, p<0.05).

Hypothesis 3 is supported, which indicates the impact of relational capabilities on value creation.The statistical result is significant of hypotheses 3 (coefficient=0.012, p<0.05).

The results indicate the positive impact of market knowledge competence, on value creation, thus confirming Hypotheses 4. The statistical result is significant of hypotheses 4 (coefficient = 0.000, p<0.05).

Finally, hypotheses 5 are supported, which indicates that impact value creation on business performance.The statistical result is significant of hypotheses 5 (coefficient = 0.000, p>0.05).

However, note that the relationship between relational capabilities and business performance is insignificant regardless of the business performance context.

Table 3 Showed that relational capabilities have insignificant effect directly to the business performance with the value (β=0.100, CR= 0.949, p>0.05). However, the test result showed that probability > 0.05 which means that relational capabilitiesinsignificant effect on business performance. Furthermore, hypotheses 1 are not supported. Marketknowledge competence has direct effect on business performance with the value (β=0.332, CR=3.404, p<0.05). However, the market knowledge competence is significant to influence on business performance. Hence, hypothesis 2 is supported.

Relational capabilities directly effect on value creation (β=0.213, CR= 2.502, p<0.05), it means that hypotheses 3 is supported. Market knowledge competence effect on value creation directly (β=0.356, CR= 4.886, p<0.05), which means that hypotheses 4 is supported. Furthermore, we can deduce that value creation has a partial mediating effect on the relation between relational capabilities and business performance, (β=0.533, CR= 3.995, p<0.05) and that support H5.

Discussion and Implication

Theoretical and practical implications

The research findings indicate that export oriented SMEs in Indonesia have relation establishment between relational capabilities and value creation, also the relation of market knowledge competence effect on business performance and value creation on business performance. In regard to the determinant of business performance in this study, we use three constructs namely relational capital (RC), Market knowledge competence (MNC) and value creation (VC). The characteristics of SMEs Furniture export oriented need to develop business networking, need to improve the competence to market access mainly related to international market and need to create value-added of products.

This research also indicates a positive correlation between value creation and business performance as well as inter-organizational relationships. These findings are consistent with earlier research and theories (Walter et al. 2001; O’Cass and Sok 2013). Walter et al. (2001) argue the theoretical considerations and conceptualize value creation is as a set of direct and indirect functions of customer relationships. The functions are characterized with respect to perform activities and employ resources of customers firm.

The relational capabilities did not support impact to business performance for the SMEs. Furthermore, this study indicate that of the relational capabilities have higher business performance, it was not supported the exported firms typology proposed (Zohdi et al. 2013; Ngugi et al. 2010; Welbourne and Val 2008). This study asserts the relational capabilities did not significant effect on SMEs business performance (Zohdi et al. 2013). Aside from that result, the analysis of internal perspective would be incomplete and it is necessary to add the relational perspective.

This research indicates a positive relationship between relational capabilities and value creation. This means that the strength of SMEs’ relational capabilities can enhance value creation. Based on literature review, Ayios (2004) argues that a relational capabilities is an organization interaction with others, it is developed by trust and commitment. Moreover, the studies have focused on understanding the behavior of capability relation of the organization and the role of corporate culture in the business relationship. This study analyzes a strength perspective that the role of inter-relationship to be important (Butler and Purchase 2008). According to Morgan and Hunt (1994), the organization needs the effort to create trust among its members, and up to higher levels of interpersonal organization. The degree of value creation makes the need to build efficient external relations to be more important. The results regarding the effect of relational capabilities indicate that the development of value creation may result in the relationship between internal capabilities and external capabilities to be positive.

Market knowledge competence has positive impact on value creation. This study consists of the relationship theories. The inter organization relationship is a competitor relationship and process of adaptability, as a result an organization intention to response its customers (Mohd Taisir Masadeh et al. 2014). Organization needs a trust as the value of special knowledge, it includes in the process and procedures of organization to anticipate the challenge of globalization. Based on literature review by Banyte and Dovaliene (2014b), they both explain that in order to reveal the relations between customer engagement to the value creation and their loyalty to the organization, it could be noticed for researchers’ interpretation.

The results confirm that the development of market knowledge competence is to enhance business performance. These results are in line with the study of Wu and Choi (2004) that asserts of mutually relationship and managerial role to enhance performance based on trust and relationship bonding interaction. The result showed that the relationships of the managerial capabilities have a positive impact on trust. Based on relationship marketing theories Kanagal (2002), the author defines as identification, maintenance, formation and association with customers to customer value creation and the organization of relations with others. The result shows, there is relationship exchange theories that is supported by transaction cost analysis and social exchange theory as indicated in this study.

Limitations and Future Research

The result of this study gives contribution on literature review, especially related to value creation in the context of a product as the result of organization business relationship network model and knowledge process on business market. The contribution of this paper that is the mediating effect of value creation in the relationship between relational capabilities on business performance is an important topic in the organization strategy framework that may be used as a conceptual model that could improve decision making. The contribution of this research verifies the effect of relational capabilities on value creation of SMEs export-oriented furniture sector. SMEs furniture export oriented also requires networking through strategic partnership to create mutual value.

This study seems unfitted to generalize of the results, since they can only be interpreted with regard to the subject population of the study and in the SMEs furniture export orientation. Furthermore, the future of the research should be applied the empirical model of business resources to other processes of the SMEs. Moreover, the measurement of the variables relational capabilities, market knowledge competence and value creation is taken from an analysis of the respondents perceptions indicated in the rating scale type questions on the questionnaire.

In this regard, it is necessary to use other methodologies, such as the application of qualitative techniques that enable the analysis of the resources based view theory and level of organizational category for more holistic perspective. It is also necessary to develop other constructs and variables that is complement the relational capabilities, value creation, market knowledge competence and business performance.

nueva página del texto (beta)

nueva página del texto (beta)