Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Contaduría y administración

versión impresa ISSN 0186-1042

Contad. Adm vol.67 no.2 Ciudad de México abr./jun. 2022 Epub 10-Jul-2024

https://doi.org/10.22201/fca.24488410e.2022.2981

Articles

Determining factors of business consolidation: An integrating approach from the entrepreneur, the company and the environment

1 Universidad Cooperativa de Colombia, Colombia.

The current study proposes an approach to determine business consolidation from the integration of factors associated with the entrepreneur, the company and the environment, through the reduction factors, the structural model and goodness of fit, through them it was possible to corroborate three relationship hypothesis and three correlation hypotheses between the factors. The empirical study was carried out on a sample of 212 entrepreneurs from various Latin American countries. The results indicate that business consolidation is determined from the entrepreneur by the perseverance, leadership, identity and decisions; from the company for the strategy, the innovation, the personnel, the market and the profitability; and from the environment for financing, competition, networks, growth and contacts.

JEL Code: J21; O18; R11

Keywords: consolidation; entrepreneur; company; environment

El presente estudio propone un enfoque para determinar la consolidación empresarial desde la integración de factores asociados al emprendedor, la empresa y el entorno, mediante la reducción de factores, el modelo estructural y la bondad de ajuste, a través de los cuales se pudo corroborar tres hipótesis de relación y tres hipótesis de correlación entre factores. El estudio empírico se realizó sobre una muestra de 212 empresarios de diversos países latinoamericanos. Los resultados indican que la consolidación empresarial está determinada desde el emprendedor por la perseverancia, el liderazgo, la identidad y las decisiones; desde la empresa por la estrategia, la innovación, el personal, el mercado y la rentabilidad; y desde el entorno por la financiación, la competencia, las redes, el crecimiento y los contactos.

Código JEL: J21; O18; R11

Palabras clave: consolidación; emprendedor; empresa; entorno

Introduction

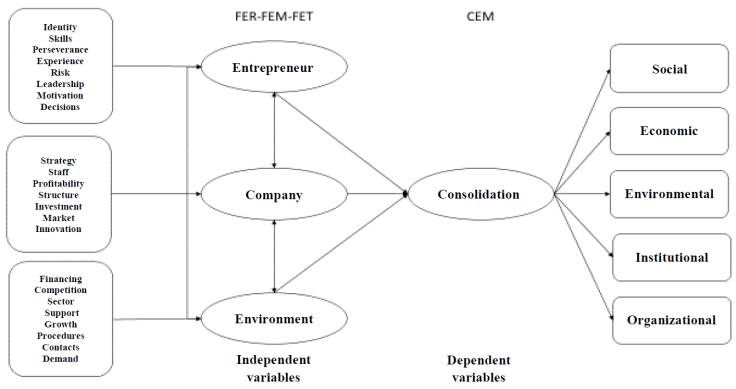

According to the Royal Spanish Academy (RAE) (Spanish: Real Academia Española), consolidation is a term that is associated with the ability to give firmness and solidity to something, to make something definitive and stable (RAE, 2014). In the business world, this definition is appropriate to understand that consolidation is related to the company's capacity to be stable and to survive over time by developing its corporate purpose under normal conditions of productivity and competitiveness. According to the Escuela de Organización Industrial (EOI) and the Instituto Cameral para la Creación y Desarrollo de la Empresa (INCYDE), there are factors associated with the entrepreneur, the company, and the environment that determine business consolidation (EOI, 2006; INCYDE, 2001).

Based on the opportunities offered by the environment, the entrepreneur is the agent who conceives and creates a company through which he or she offers products and services to satisfy human needs in exchange for generating economic benefits. In order to achieve this, the company must consolidate over time. Using an integrating approach, the purpose of this research is to determine the factors of the entrepreneur, the company, and the environment that have the greatest influence on the consolidation of a company.

Factors that explain entrepreneurship

The term entrepreneur is related to the resolution and determination to start a business amid danger, difficulty, and uncertainty. It originally referred to adventurers, then contractors, until it shifted to meanings related to business activity and function (Arango, 2011; Arango, 2017). The entrepreneur seeks business opportunities, takes risks, and has intelligence, optimism, creativity, and persistence in achieving the goals they set for themselves (Brunet & Alarcón, 2004; Corrêa et al., 2017; Terapuez & Botero, 2007). The entrepreneur has innate abilities (trait theory), feels high job satisfaction (behavioral theory), is capable of multitasking (role theory), and can interact in diverse situations efficiently (situational theory) (Escandon & Hurtado, 2016).

In order to start a business, self-knowledge as an entrepreneur is necessary (Valenciano & Uribe, 2009; Ynzunza et al., 2020). Knowing one's limitations and strengths helps to identify the right conditions to undertake a new business (Pazmiño et al., 2018; Plaza, 2015; Silveira et al., 2015). In a similar sense, the experience acquired enables the entrepreneur to manage their business better and increase the probability of achieving business success, which is also related to the ability to match business strategies with the situation of the sector and the needs of the clients (Escandon & Hurtado, 2014; Escandon & Hurtado, 2016; Franco & Urbano, 2010). Nevertheless, education and entrepreneurial ability are not necessary conditions to initiate a new business (Diez et al., 2021).

Factors explaining the company

Companies exist because markets are imperfect and because through them the means of production are combined to produce goods and provide services whose prices are determined by market fluctuations (Brunet & Alarcón, 2004; Coase, 1937; Urbano et al., 2007). Companies also exist because of contracts, transactions and exchanges, which enable the transfer of assets between different stakeholders (Urbano et al., 2007; Williamson, 1985). The company can be the result of rational decisions (rational choice theory) that drive the search for economic benefit (expected profit theory), the result of the occurrence of a negative critical event (marginalization theory), or the result of the ability to integrate and leverage controlled resources optimally and strategically (resources and capabilities theory) (Brunet & Alarcón, 2004; Franco & Urbano, 2010; Martínez & Martínez, 2008; Morales & Segoviano, 2016).

Companies differ despite carrying out similar activities and competing in similar markets (Cuervo, 2004). Consolidated companies adapt easily to the environment, promote cooperation, satisfy needs, contribute to local development, do what is useful and necessary, spread solidarity, innovate, develop new products and services, capitalize, and know how to take advantage of environmental opportunities (López & Calderón, 2006; Sanchis, 2001). Human resource management, task assignment, training and education, teamwork, motivation, a trained entrepreneur, and staff that complements their deficiencies are aspects that favorably affect the growth and consolidation of the company (Carmona et al., 2015; López & Calderón, 2006; Valenciano & Uribe, 2009; Vílchez et al., 2019).

Factors that explain the environment

The environment provides cultural factors and values that impact the entrepreneur and the company (Alvarez et al., 2010; Camino & Aguilar, 2017). The behavior of the entrepreneur and the company is defined by regulations and rules (institutional economic theory) that through selectivity condition their permanence (ecological theory of population) in an environment whose interconnection of its agents (network theory) determines their consolidation to the extent that their actions are perceived as credible (role theory) (Brunet & Alarcón, 2004). Likewise, the influence of the environment is linked to local production systems that are also related to Marshallian industrial districts, in which it is suggested that there are sectors that are selectively more productive than others, either for geographical, social, cultural, or economic reasons (Boix & Galletto, 2005; Brunet & Alarcón, 2004; Climent, 1997).

Companies distrust each other and try to hide their strengths, weaknesses, and difficulties; they are very closed and selective in their commercial relations (López & Calderón, 2006). The aid that companies receive from the environment can contribute to their consolidation and improve their competitiveness, innovation, and development (Cardona et al., 2008; García et al., 2017; Plaza, 2015; Valenciano & Uribe, 2009). The environment influences entrepreneurial activity (Chaves et al., 2018) and provides aids such as business advice, partnership, and funding sources that are conditional on the consolidation of companies (Bada et al., 2017; Sanchis, 2001; Valenciano & Uribe, 2009). Thus, the cooperative approach, which is based on support networks, collectivity, and associativity, is a key factor in the success of companies (Di Masso et al., 2021; Kasparian & Rebón, 2020; Mera et al., 2018). Moreover, this approach could be applied to all types of companies regardless of their legal form, whether for-profit or not-for-profit.

Factors explaining consolidation

Business consolidation is related to several factors that determine it (Plaza, 2015). According to the Association of Young Entrepreneurs (AJE) (Spanish: Asociación de Jóvenes Empresarios), business consolidation creates the conditions for the company to endure over time under profitable conditions (AJE, 2015). Consolidation is a challenge for new companies and a characteristic of success for those that have endured in the markets in which they operate (Anaya, 2014). Consolidation is determined by economic, commercial, technological, social, and cultural aspects (external factors), as well as by commitment, quality, service, loyalty, compliance, and dedication to work (internal factors) (López & Calderón, 2006). Nonetheless, the company's consolidation is framed by internal tensions generated by the demand for productivity and competitiveness to achieve business success (Bastida et al., 2020; Figari, 2019).

Business consolidation follows a gradual process of planning, organization, and execution of technical, human, and financial resources toward an advanced state of innovation, which largely depends on the degree of productivity, competitiveness, and entrepreneurship achieved (AJE, 2015; Melo et al., 2021; Valenciano & Uribe, 2009). Consolidation is reflected in the value of assets, employment generated, organizational status, business profit, and decreased risk (Jurado, 2018; Sanchis, 2001). Strengthening organizational resources and capabilities contributes to the consolidation of the business project (Acosta, 2013; Araya et al., 2017). Likewise, sectoral support, financing, taxation, research, innovation, organizational culture, administrative procedures, and the qualifications of the entrepreneur are essential factors in any business consolidation process (Camino & Aguilar, 2017; Foncubierta et al., 2020; Plaza, 2015; Texis et al., 2016).

Lack of planning, management, quality, training, and technical capabilities, as well as low productivity and competitiveness, weakness in obtaining suppliers, failures in defining a market niche, not having facilities, informality in organizational processes, and lack of knowledge of the sector, are factors that affect the consolidation of the companies (AJE, 2015; Durán & San Martin, 2013; Rodríguez & Dussán, 2018; Texis et al. 2016). Likewise, there is a positive relation between business consolidation and the professional option of creating a new company by keeping adequate accounting and finances in line with the requirements of recording the economic transactions of the new business (Álvarez et al., 2011; Ibarra et al., 2017).

Consequently, business consolidation depends more on integrated factors of the entrepreneur, the company, and the environment than on factors viewed individually (Table 1).

Table 1 Factors that facilitate and hinder business consolidation

| Variable | Factors facilitating consolidation | Factors hindering consolidation |

|---|---|---|

| Entrepreneur | Experience, individual motivations, training, and vision for growth | Lack of motivation, limited experience, a small number of members |

| Company | Its capacity for innovation, the cohesion of the management team, the quality of the product | Small size, low investment, low innovative capacity |

| Environment | Market positioning, support networks, sources of financing | The scarcity of skilled labor, little financial support, the low dynamism of the sector |

Source: Created by the author based on EOI (2006)

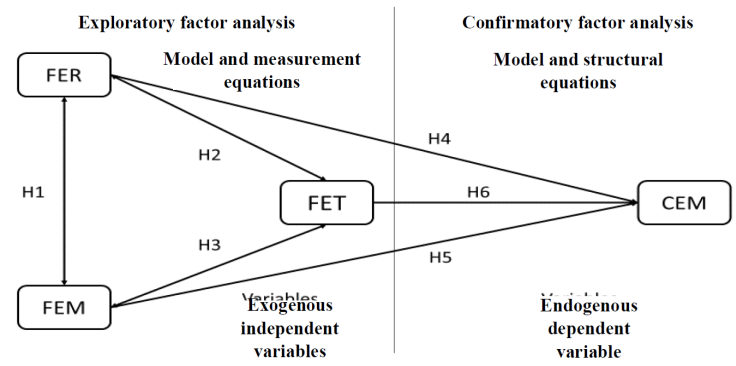

Research hypothesis

The research hypotheses are correlation and relation hypotheses (Hernández et al., 2014). In order to establish these hypotheses, Entrepreneur Factors (FER), Company Factors (FEM), and Environment Factors (FET) were defined as independent variables, and Business Consolidation Factors (CEM) as the dependent variable (Table 2).

Table 2 Correlation and relation hypotheses

| Correlation hypothesis | Hypothesis of relation |

|---|---|

| H1: there is a correlation between FER and FEM | H4: There is a relation between FER and CEM |

| H2: there is a correlation between FER and FET | H5: There is a relation between FEM and CEM |

| H3: There is a correlation between FEM and FET | H6: There is a relation between FET and CEM |

Source: Created by the author

Methodology

Subject of research

This paper aims to identify the factors that determine business consolidation based on integrating factors associated with the entrepreneur, the company, and the environment. Statistical analysis could determine this integration based on the correlation and relation between the variables under study.

Observation instrument

The information was obtained through a questionnaire structured in nine dimensions of Demographic Factors (DF), eight Entrepreneur Factors (FER), seven Company Factors (FEM), eight Environment Factors (FET), and five Business Consolidation Factors (CEM). The evaluation scale was a Likert scale from 1 to 4, where 1: strongly disagree, 2: disagree, 3: agree, and 4: strongly agree (Table 3).

Theoretical model

Based on the variables and their dimensions, the theoretical model of correlations and relations was defined to respond to the research hypotheses (Figure 1).

Sample selection

The target population was large, medium, small, and micro enterprises in the Latin American context. The sample was selected by simple random sampling. With a finite population, 95% confidence level and maximum variance, the sampling error was 6.32%. The questionnaire was e-mailed to 1 800 businesspeople and managers of commercial, industrial, service, and agricultural companies. The data collection time was eight months between 2018 and 2019, with a response rate of 11.78%, corresponding to 212 respondents.

Descriptive analysis

The largest share by country is in Colombia (91.9%), followed by Mexico (2.8%), Bolivia, and Chile, with shares close to 2%, and Spain and Panama, with less than 1% shares. Regarding corporate purpose, the greatest participation was in service companies (66.4%), followed by commercial companies (17.5%). Regarding the type of company, micro companies have the largest share (38.9%), followed by small (26.5%), while medium and large companies have shares slightly above 17% (Table 4).

Table 4 Frequency by country, corporate purpose, and type of company

| Country | No. | Weight | Object | No. | Weight | Company | No. | Weight |

|---|---|---|---|---|---|---|---|---|

| Bolivia | 4 | 1.9 | Commerce | 37 | 17.5 | Micro | 83 | 39.2 |

| Chile | 4 | 1.9 | Industry | 20 | 9.4 | Small | 56 | 26.4 |

| Colombia | 195 | 92.0 | Services | 141 | 66.5 | Medium | 36 | 17.0 |

| Spain | 1 | .5 | Agriculture and Livestock | 14 | 6.6 | Large | 37 | 17.5 |

| Mexico | 6 | 2.8 | ||||||

| Panama | 2 | .9 | ||||||

| Total | 212 | 100.0 | 212 | 100.0 | 212 | 100.0 |

Source: Created by the author based on SPSS 24 statistics

Statistical model

The statistical model is a structural model constructed from exploratory and confirmatory factor analysis. In this model, the FER, FEM and FET factors are the independent and exogenous variables, and the CEM factors are the dependent and endogenous variables. There are three correlation hypotheses among FER, FEM, and FET: H1, H2, and H3; among FER, FEM, FET, and CEM, there are three relation hypotheses: H4, H5, and H6 (Figure 2).

Normality and homogeneity

The normality of the variables was determined using the Kolmogorov-Smirnov (K-S) test, which compares the theoretical distribution function with the empirical distribution (Pedrosa et al., 2014). A p-value ≤ 0.05 indicates that the variables do not meet the normality condition. The K-S test showed that the p-value of FER, FEM, and FET is less than 0.05, while the p-value of CEM is greater than 0.05. The homogeneity of the variables was determined using Levene's test, which establishes whether the variances of the observed groups are statistically equal. A p-value≤0.05 indicates that the variables do not meet the homogeneity condition. Levene's test showed that the p-value of FER, FEM, FET, and CEM is greater than 0.05, i.e., their variances are homogeneous (Table 5).

Table 5 Normality and homogeneity test

| Variable | Kolmogorov-Smirnov (K-S) | Levene | ||||||

|---|---|---|---|---|---|---|---|---|

| Statistical | p-value | Criteria | Statistical | gl1 | gl2 | Sig. | Criteria | |

| FER | .070 | .014 | Non-normal | .282 | 3 | 208 | .839 | Homogeneous |

| FEM | .089 | .000 | Non-normal | .267 | 3 | 208 | .849 | Homogeneous |

| FET | .063 | .043 | Non-normal | .335 | 3 | 208 | .800 | Homogeneous |

| CEM | .059 | .074 | Normal | 1.469 | 3 | 208 | .224 | Homogeneous |

Source: Created by the author based on SPSS 24 statistics

Considering that at least one of the criteria for parametric tests is not met (Berlanga & Rubio, 2012; Rubio & Berlanga, 2012), the statistical tests performed were nonparametric, which is likewise corroborated by the descriptive results of skewness and kurtosis (Table 6).

Table 6 Normality and homogeneity characteristics

| Variable | Normality | Homogeneity | Sample | Type | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| FER | Non-normal | Homogeneous | 212 | Ordinal | -.189 | -.450 |

| FEM | Non-normal | Homogeneous | 212 | Ordinal | .247 | -.403 |

| FET | Non-normal | Homogeneous | 212 | Ordinal | .182 | -.130 |

| CEM | Normal | Homogeneous | 212 | Ordinal | -.198 | -.425 |

Source: Created by the author based on SPSS 24 statistics

Consistency and reliability

Sample consistency was determined using the Kruskal-Wallis (K-W) test, which ascertains whether the sample comes from identical or different populations. A p-value≤0.05 indicates that the sample comes from different populations. The K-W test showed that for FER and FEM, the sample comes from identical populations, while for FET and CEM, the sample comes from different populations. Meanwhile, the reliability of the observation instrument was determined by Cronbach's Alpha, which indicates the degree to which the different items are consistent and can be used to measure the same magnitude (Cupani, 2012). Values close to 1 indicate that the instrument used is reliable. Cronbach's alpha showed that FER, FEM, FET, and CEM have values above 0.80, indicating that the instrument is reliable, the items that comprise it are consistent, and the data obtained can be used in statistical analyses (Table 7).

Table 7 Kruskal-Wallis test by variable and type of organization

| Variable | Kruskal-Wallis | Cronbach's alpha | ||||

|---|---|---|---|---|---|---|

| Chi-square | gl | p-value | Criteria | Statistical | Criteria | |

| FER | .974 | 3 | .808 | Identical | .912 | Reliable |

| FEM | 5.970 | 3 | .113 | Identical | .890 | Reliable |

| FET | 8.224 | 3 | .042 | Different | .809 | Reliable |

| CEM | 11.593 | 3 | .009 | Different | .918 | Reliable |

Source: Created by the author based on SPSS 24 statistics

Construct validity

Construct validity enables the statistical validation of items grouped into factors and is determined by convergent and discriminant validity (Hayton et a., 2004). Convergent validity is obtained through the Expected Cross Validation (ECV) and Composite Reliability (CF) indices. The closer the ECV and CF are to 1, the higher the correlation between the items. The ECV of the FER, FEM, FET, and CEM items indicated an acceptable correlation, while the CF showed that the FER and FEM items were highly reliable and that the FET and CEM items were reliable. Discriminant validity is measured with the Mean-Variance Extracted (MVE) index, which measures the theoretical differences between the study variables, which are expected to have lower correlations on a scale. The VME showed that the theoretical differences between FER, FEM, FET, and CEM are acceptable (Table 8).

Table 8 Convergent validity and discriminant validity

| Variable | Convergent validity | Discriminant validity | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| ECV | Criteria | CF | Criteria | MVE | FER | FEM | FET | CEM | Criteria | |

| FER | .692 | Acceptable | .830 | Highly reliable | .465 | .682 | Acceptable | |||

| FEM | .692 | Acceptable | .801 | Highly reliable | .415 | .373 | .644 | Acceptable | ||

| FET | .773 | Acceptable | .689 | Reliable | .315 | .129 | .438 | .562 | Acceptable | |

| CEM | .550 | Acceptable | .756 | Reliable | .511 | .282 | .461 | .294 | .715 | Acceptable |

Source: Created by the author based on AMOS 24 statistics

Results

Exploratory factor analysis

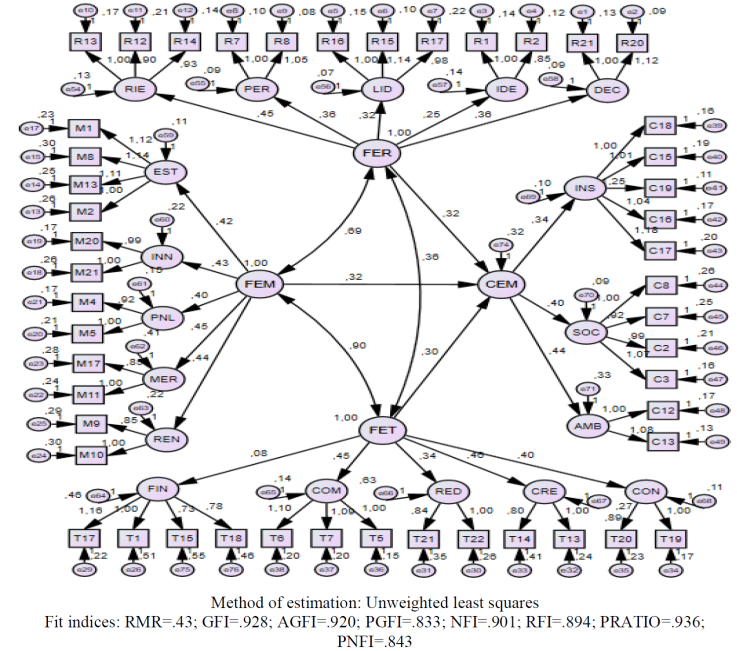

Since the original data did not satisfy the normality condition, the Exploratory Factor Analysis (EFA) was performed using nonparametric statistical tests, with an unweighted least squares extraction method, varimax rotation method with Kaiser normalization, and factor loading level greater than 0.50. Values with factor loadings lower than 0.50 were not considered for the definition of the structural model.

KMO index and Barlett's test

The Kaiser-Meyer-Olkin index (KMO) compares the correlations of the variables and their partial correlations. Only with values close to l can factor analysis be performed reliably. Barlett's test of sphericity establishes whether the correlation matrix is an identity matrix and, if so, it would not be appropriate to carry out the factor analysis. A p-value≤0.05 indicates that the matrix is not of identity and is appropriate to perform factor analysis (De la Fuente, 1999). The KMO index showed that the sample adequacy of FER, FEM, and CEM is good, and that of FET is acceptable. Barlett's test showed that the correlation matrix is not identical and that it is appropriate to perform the factor analysis (Table 9).

Table 9 KMO test and Barlett's test

| Variable | Kaiser-Meyer-Olkin | Barlett | ||||

|---|---|---|---|---|---|---|

| Value | Criteria | Chi-square | gl | Sig. | Criteria | |

| FER | .870 | Good | 2200.253 | 231 | .000 | Suitable |

| FEM | .836 | Good | 2002.061 | 231 | .000 | Suitable |

| FET | .767 | Acceptable | 1667.747 | 253 | .000 | Suitable |

| CEM | .880 | Good | 2684.969 | 253 | .000 | Suitable |

Source: Created by the author based on SPSS 24 statistics

Rotated factor matrix

The varimax rotation for unweighted least squares made it possible to group the items by factorial homogeneity and eliminate those with factor loadings lower than 0.50 (De la Fuente, 1999). 12 of the 22 FER items were grouped into five factors, 12 of the 22 FEM items into five factors, 13 of the 23 FET items into five factors, and 11 of the 23 CEM items into three factors (Table 10).

Table 10 Rotated factor matrix of FER, FEM, FET, and CEM

| Variable | Construct | Description | Average load | Number of items | Total items |

|---|---|---|---|---|---|

| FER | RIE | Risk | .727 | 3 | 12 |

| PER | Perseverance | .735 | 2 | ||

| LID | Leadership | .644 | 3 | ||

| IDE | Identity | .670 | 2 | ||

| DEC | Decisions | .725 | 2 | ||

| FEM | EST | Strategy | .694 | 4 | 12 |

| INN | Innovation | .760 | 2 | ||

| PNL | Staff | .650 | 2 | ||

| MER | Market | .671 | 2 | ||

| REN | Profitability | .666 | 2 | ||

| FET | FIN | Financing | .691 | 4 | 13 |

| COM | Competition | .750 | 3 | ||

| RED | Networks | .797 | 2 | ||

| CRE | Growth | .656 | 2 | ||

| CON | Contacts | .670 | 2 | ||

| CEM | INS | Institutional | .724 | 5 | 11 |

| SOC | Social | .638 | 4 | ||

| AMB | Environmental | .831 | 2 |

Source: Created by the author based on SPSS 24 statistics

The above items are those that statistically best explain the research phenomenon and are considered to estimate the structural model through Confirmatory Factor Analysis (CFA).

Confirmatory factor analysis

Confirmatory Factor Analysis (CFA) consists of estimating the statistical parameters that determine the correlations and relations between the structural model's variables, constructs, and indicators. The CFA allows the deletion of other items to seek a better model fit while enabling the statistical parameters to be contrasted for the corroboration or rejection of the research hypotheses (Escobedo et al., 2016; García, 2011; Mavrou, 2015).

Structural model

The structural model integrates the statistical parameters of the correlations and relations between the independent and dependent variables in the same graph and essentially deals with testing the research hypotheses. Structural models are regression equations with measurement errors corresponding to unexplained variances between the independent and dependent variables (Cupani, 2012; Garcia, 2011; Lara, 2014). Respecification allows the addition or removal of parameters according to higher factor loadings or lower measurement errors seeking an acceptable model fit (Cupani, 2012; Escobedo et al., 2016).

Using the structural model, it was possible to determine a correlation of 0.69 and a mutual influence of 48% between FER and FEM. FER and FET have a correlation of 0.36 and a mutual influence of 13%. Furthermore, between FEM and FET there is a correlation of 0.90 and a mutual influence of 81%. On the other hand, the relation between FER and CEM is 0.32, between FEM and CEM is 0.32, and between FET and CEM is 0.30, i.e., an influence of 10%, 10%, and 9%, respectively, showing that CEM is explained proportionally by FER, FEM, and FET (Figure 3).

Model identification

The model identification is defined in degrees of freedom (g). If g<0, there is no identification. If g=0 there is identification, and if g>0 there is over-identification (Escobedo et al., 2016; Lara, 2014). The proposed model is expected to be over-identified (g>0). It presents multiple solutions because the data matrix has more information than the number of parameters to be estimated. The more degrees of freedom (g) the model has, the more parsimonious it is and, therefore, the better the fit of the data and the correlations and relations between the independent and dependent variables can be tested (Cupani, 2012).

The calculations showed that the data present g>0 values, i.e., that the statistical models are over-identified, i.e., that they present multiple possible solutions and that the correlations and relations between the variables can be verified (Table 11).

Table 11 Identification of statistical models

| Type of model | Variances and covariances (s) | Parameters (t) | Degrees of freedom (g=s-t) | Criteria |

|---|---|---|---|---|

| FER measurement model | 78 | 34 | 44 | Over identified |

| FEM measurement model | 78 | 34 | 44 | Over identified |

| FET measurement model | 91 | 36 | 55 | Over identified |

| CEM measurement model | 66 | 25 | 41 | Over identified |

| Structural model | 1176 | 119 | 1057 | Over identified |

Source: Created by the author based on AMOS 24 statistics

Model fit

Model fit is determined based on goodness of fit indices, the calculation of which makes it possible to evaluate the extent to which the model reproduces the correlations and relations between the variables that define it (Escobedo et al., 2016; Lara, 2014). The calculated goodness of fit indices were the root mean square error index (RMR), goodness of fit index (GFI), adjusted goodness of fit index (AGFI), parsimony goodness of fit index (PGFI), normed goodness of fit index (NFI), relative fit index (RFI), parsimony relation (PRATIO), and parsimony normed fit index (PNFI). The calculations show that the statistical models acceptably specify the correlations and relations between the independent and dependent variables (Table 12).

Table 12 Goodness of fit indices of statistical models

| Adjustment index | Acronym | Range | FER | FEM | FET | CEM | Criteria |

|---|---|---|---|---|---|---|---|

| Mean square error rate | RMR | Close to 0 | .016 | .029 | .047 | .037 | Acceptable |

| Goodness of fit index | GFI | >.90 | .992 | .988 | .971 | .977 | Acceptable |

| Adjusted goodness of fit index | AGFI | >.90 | .985 | .978 | .952 | .964 | Acceptable |

| Parsimony goodness of fit index | PGFI | >value | .559 | .557 | .587 | .607 | Acceptable |

| Normed index of adjustment | NFI | >.90 | .987 | .978 | .940 | .965 | Acceptable |

| Relative adjustment index | RFI | >.90 | .980 | .968 | .915 | .953 | Acceptable |

| Parsimony relation | PRATIO | >value | .667 | .667 | .705 | .745 | Acceptable |

| Parsimony index of adjustment | PNFI | >value | .658 | .652 | .663 | .719 | Acceptable |

Source: Created by the author based on AMOS 24 statistics

Statistical testing of hypotheses

Structural models allow the testing of research hypotheses (Escobedo et al., 2016). Likewise, to corroborate the working hypotheses, the p found can be compared with the statistical significance defined by p-value ≤ 0.05. If the p-value found is less than the statistical significance, the null hypothesis is rejected; otherwise, it is accepted (Leenen, 2012). The present research, which was based on the structural equation model, takes root mean square error ratio (RMR) as the test parameter (Table 12), which is less than the statistical significance and shows an acceptable fit of the model, thus enabling acceptance of the working hypotheses, which in turn is reflected in the correlations, relations, and influences shown by the structural model. From the results obtained, it is corroborated that there are positive correlations and relations between the variables under study (Table 13).

Table 13 Summary statistics for hypothesis testing

| Research hypothesis | Result 𝜆 | Influence 𝜆2 | Criteria |

|---|---|---|---|

| Correlation hypothesis | |||

| H1: there is a correlation between FER and FEM | 0.69 | 48% | Positive correlation |

| H2: there is a correlation between FER and FET | 0.36 | 13% | Positive correlation |

| H3: There is a correlation between FEM and FET | 0.90 | 81% | Positive correlation |

| Relation hypothesis | |||

| H4: There is a relation between FER and CEM | 0.32 | 10% | Positive relation |

| H5: There is a relation between FEM and CEM | 0.32 | 10% | Positive relation |

| H6: there is a relation between FET and CEM | 0.30 | 9% | Positive relation |

Source: Created by the author based on AMOS 24 statistics

Discussion

Business consolidation involves the confluence of several factors. These factors have been studied separately through influence models. The present research proposed a business consolidation model that integrates factors of the entrepreneur, the company, and the environment. From the entrepreneur's point of view, perseverance, leadership, and the ability to make decisions are factors that influence the consolidation of a company, which is corroborated by Ynzunza et al. (2020). In studies conducted on business performance, they found that entrepreneurial skills are a determining factor in the decision to start a new company.

In companies, it was evident that staff management is a determining factor in consolidation, as confirmed by Vílchez et al. (2019), who found that a poorly paid and poorly trained employee negatively influences the company's performance. Nevertheless, Diez et al. (2021) found that education, entrepreneurship, and research and development transfer do not influence the creation of a business. On the contrary, in the present research, it was found that innovation, which is related to research and development, is a determining factor in a company's consolidation.

Garcia et al. (2017) find that competitiveness is defined by aspects related to the economy, market, infrastructure, education, health, human capital, and knowledge. Although this study does not deal directly with competitiveness, it does have a relation with competition, which is a determining environmental factor in the consolidation of a company. Similarly, studies conducted by Bada et al. (2017) find that government support and policies are key in associativity concerning support networks and contacts, which are environmental factors that determine business consolidation according to the present research.

Along these lines, the statistical verification of the research hypotheses corroborates that entrepreneurial activity is based on the individual, the organization, and the environment, as also affirmed by Cuervo et al. (1979). In fact, in this research it was possible to demonstrate correlations between factors associated with the entrepreneur, the company, and the environment and that these factors are related and explain business consolidation (Table 14).

Table 14 Factors that define business consolidation

| Entrepreneurial factors | Weight | Company Factors | Weight | Environmental factors | Weight | Consolidation factors | Weight |

|---|---|---|---|---|---|---|---|

| Risk | 61% | Strategy | 62% | Financing1 | 1% | Institutional | 54% |

| Perseverance | 60% | Innovation | 45% | Competence | 60% | Social | 62% |

| Leadership | 59% | Staff | 52% | Networks | 15% | Environmental | 37% |

| Identity | 30% | Market | 33% | Growth | 44% | ||

| Decisions | 59% | Profitability | 47% | Contacts | 60% |

Source: Created by the author based on AMOS 24 statistics

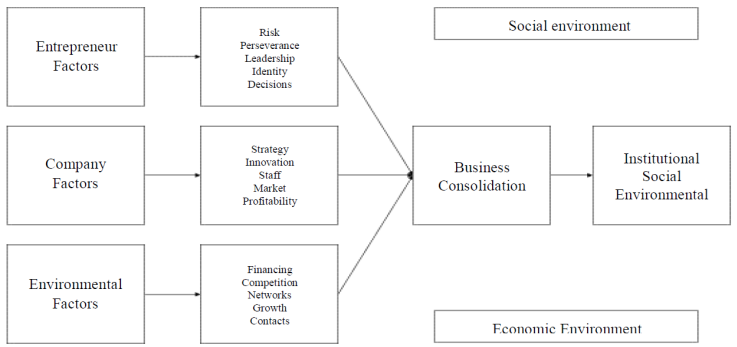

Based on the above, a profile of the entrepreneur, the company, the environment, and their relation to business consolidation is proposed. An entrepreneur is an individual who takes risks considering data, experience, and effects; perseveres in the search for positive changes and concrete solutions; assumes leadership based on willingness, drive, and creative questioning; knows their limitations and strengths; and makes decisions by analyzing consequences with the support of information. The company has a strategy based on plans, indicators, and processes; it innovates based on continuous improvement in processes, products, and services; it has competent personnel who work as a team; it has several lines of business, products, and services; and its profitability is based on a healthy portfolio and productive use of its resources. The environment provides financing based on credit procedures, external sources, and growth in debt; it fosters competition in prices and costs; establishes marketing and business information networks; conditions business growth by merging personnel and asset volume; and requires contact with clients and suppliers. Institutional, social, and environmental factors define business consolidation. Institutionally, it complies with accounting, tax, labor, commercial, and environmental regulations; socially, it creates conditions for equality among people, gender equity, and respect for values; and environmentally, it complies with protocols for the care of and investment in the environment.

Conclusions

Business consolidation is a major challenge due to the complexity of the relations between the variables involved. The purpose of this research was to statistically test the correlation and relation between factors that determine business consolidation. In general terms, business consolidation consists of a company's long-term survival in the markets in which it operates once it has overcome the first years of activity, which are the most critical and determining factors for its business survival.

Traditionally, financial aspects, especially sales and profits, have been the key factors in the survival of companies. Over time, other factors, both quantitative and qualitative, have also played a key role in this survival. Quantitative factors include the value of assets, number of members, level of indebtedness, and level of costs. Qualitative aspects include motivation, perseverance, quality, and market dynamics.

Some studies have delved into the factors of the entrepreneur, others into the factors of the company, and others into the factors of the environment, but separately, in what they have called the factors of the company's success. The contribution of this research is that it integrates the factors of the entrepreneur, the company, and the environment into a model of business consolidation from which different actors can have a global vision of the factors that influence company performance.

Using multivariate statistics in social research, specifically exploratory and confirmatory factor analysis, has made it possible to empirically test research hypotheses that would otherwise remain at the level of speculation. Indeed, the correlation and relation between these factors and business consolidation were corroborated in an integrated manner.

After methodological refinement, the entrepreneur factors were reduced to five, the company factors to five, and the environmental factors that determine business consolidation to five. It is suggested that factors discarded to improve the statistical fit of the structural model, although theoretically related to business consolidation, should be left out of the analysis. This opens up the option of similar research concerning the factors determining business consolidation.

Indeed, the statistical results have corroborated that the entrepreneur's risk, perseverance, leadership, identity, and decisions, the company's strategy, innovation, staff, market, and profitability, and the environment's financing, competition, networks, growth, and contacts are the factors that determine business consolidation, which in turn is explained by institutional factors (regulations and laws), social factors (equality and equity), and environmental factors (care and investment).

Business consolidation model

Based on the statistical results, a business consolidation model that relates the factors of the entrepreneur, the company, and the environment is proposed. The model is intended as a graphic reference to help simplify the complex relations between the factors that determine business consolidation and is not intended to be a definitive model (Figure 4).

The above model considers that risk, perseverance, leadership, identity, and decisions are the factors that define the entrepreneur and have the greatest influence on the consolidation process of a company. Strategy, innovation, personnel, market, and profitability define the market and have the greatest influence on the consolidation process of a company. Likewise, financing, competition, networks, growth, and contacts are the factors that define the environment and also have the greatest influence on the consolidation of a company. Institutional, social, and environmental factors define such consolidation. In addition, there is an economic and social environment since there are factors associated with these dimensions that, although beyond the company's internal control, significantly influence its birth, survival, and consolidation. The statistical results of correlation and relation between the factors that were reduced through factor analysis reflect the fact that the model applies to any company, regardless of its corporate purpose or size. That is, not all companies need to be large to be consolidated companies in the markets in which they operate. Micro, small and medium-sized companies are consolidated when the factors represented in this model come together.

Limitations and implications

One limitation was collecting information from the surveyed population (entrepreneurs and company managers). Although a wide dissemination of the surveys was made with repetitive mailings and various time lapses between 2018 and 2019, out of 1800 surveys sent out, 212 were received. Although a larger response rate was expected, the sample collected is considered acceptable for factor analysis in statistical distributions that do not meet the normality condition. This situation may be due to a growing reluctance among entrepreneurs in Latin American countries to respond to surveys via e-mail, an aspect beyond the research's control. Although the research was intended to cover several Latin American countries, Colombia and Mexico were the countries that contributed the most, so the results are more influenced by businesspeople from these two countries.

A second limitation was the reduction through factor analysis of the original factors to a smaller number seeking a better model fit, which, although limited compared to a wider range, are considered sufficient to determine correlations and statistical relations with the factors that determine business consolidation.

A third limitation could be the Covid-19 effect on business consolidation since the data collection was before the pandemic2, and it is evident that business dynamics were substantially affected by this phenomenon that has influenced social, economic, and business aspects. Nevertheless, it is considered that the research results are still valid, and future research should statistically analyze the correlation and relation of this type of phenomenon in the consolidation of companies.

The implications are that the entrepreneur, the company, and the environment are a unit that determines the durability of the companies over time. A possible subject of future studies could be to test the proposed model in other countries, sectors, and economic activities.

REFERENCES

Acosta, J. C. (2013). Los informes de capital intelectual en nuevas empresas de base tecnológica: la experiencia de los parques científicos y tecnológicos de Madrid. Revista EAN. http://journal.ean.edu.co/index.php/Revista/article/view/574 [ Links ]

AJE. (2015). Análisis de los factores que contribuyen al exito de proyectos empresariales. 1-91. [ Links ]

Álvarez, A., Galindo, M. Á., & Valencia, P. (2010). Determinantes de la consolidación empresarial en España. Revista Europea de Dirección y Economía de La Empresa, 19, 49-59. [ Links ]

Álvarez, A., Valencia, P., & Martínez, M. P. (2011). Aspectos que influyen en la consolidación de empresas: evidencias obtenidas en 14 países. Ingeniare. Revista Chilena de Ingeniería, 19(2), 233-239. [ Links ]

Anaya, E. J. (2014). Factores determinantes de la perdurabilidad de las empresas MIPYMES comerciales en el municipio de Sincelejo-Sucre: Apreciaciones de los directivos. (p. 53). Universidad Nacional de Colombia. [ Links ]

Arango, J. J. (2011). Identificación de los factores que tienen mayor relevancia en la creación de una nueva empresa en la ciudad de medellín desde la perspectiva del emprendedor empresarial. Caso: Parque del Emprendimiento. Repositorio Universidad de Medellín, 159. [ Links ]

Arango, J. J. (2017). Identificación de factores esenciales para la creación de empresas desde la perspectiva del emprendedor: caso Parque del Emprendimiento. Cuadernos de Contabilidad, 18(45). [ Links ]

Araya, S., Rojas, L., & Ruiz, E. (2017). Aspectos importantes en la consolidación de una empresa: Una mirada desde el sector comercio. Revista Academia & Negocios, 3(1), 11-22. [ Links ]

Bada, L. M., Rivas, L. A., & Littlewood, H. F. (2017). Modelo de asociatividad en la cadena productiva en las Mipymes agroindustriales. Contaduria y Administracion, 62(4), 1100-1117. https://doi.org/10.1016/j.cya.2017.06.006 [ Links ]

Bastida, M., Blanco, A. O., & Saball, T. (2020). Medidas para el fomento y consolidación de un ecosistema favorable a la econmía social en Galicia. La red de consumo. CIRIEC-Espana Revista de Economia Publica, Social y Cooperativa, 98, 59-94. https://doi.org/10.7203/CIRIEC-E.98.15872 [ Links ]

Batista, J. M., Coenders, G., & Alonso, J. (2004). Análisis factorial confirmatorio. Su utilidad en la validación de cuestionarios relacionados con la salud. Medicina Clinica, 122(SUPPL. 1), 21-27. https://doi.org/10.1157/13057542 [ Links ]

Berlanga, V., & Rubio, M. J. (2012). Clasificación de pruebas no paramétricas. Cómo aplicarlas. Revista d’Innovació i Recerca En Educació, 5, 101-113. https://doi.org/10.1344/reire2012.5.2528 [ Links ]

Brunet, I., & Alarcón, A. (2004). Teorías sobre la figura del emprendedor. Papers 73, 81-103. [ Links ]

Camino, R. C., & Aguilar, A. E. (2017). Emprendimiento e innovación en Ecuador, análisis de ecosistemas empresariales para la consolidación de pequeñas y medianas empresas. INNOVA Research Journal, 2(9.1), 73-87. https://doi.org/10.33890/innova.v2.n9.1.2017.504 [ Links ]

Cardona, M., Vera, L. D., & Tabares, J. (2008). Las dimensiones del emprendimiento empresarial: la experiencia de los programas cultura e y fondo emprender en Medellín. Cuadernos de Investigación, 69, 72. https://doi.org/10.2139/ssrn.2459621 [ Links ]

Carmona, M. A., Suárez, E. M., Calvo, A., & Periáñez, R. (2015). Sistemas de gestión de la calidad: un estudio en empresas del sur de España y norte de Marruecos. Investigaciones Europeas de Dirección y Economía de La Empresa, 1-9. https://doi.org/10.1016/j.iedee.2015.10.001 [ Links ]

Chaves, M., Fedriani, E. M., & Ordaz, J. A. (2018). Factores relevantes para optimizar los servicios públicos de apoyo a los emprendedores y la tasa de supervivencia de las empresas. Innovar, 28(69), 9-24. https://doi.org/10.15446/innovar.v28n69.71693 [ Links ]

Coase, R. H. (1937). The Nature of the Firm. Economica, 4(16), 386. https://doi.org/10.2307/2626876 [ Links ]

Corrêa, V. S., Vale, G. M. V., & Cruz, M. de A. (2017). Entrepreneurial orientation and religion: the Pastor as an entrepreneur. Revista de Administração, 52(3), 330-340. https://doi.org/10.1016/j.rausp.2016.10.005 [ Links ]

Cuervo, Á., Ribeiro, D., & Roig, S. (1979). Entrepreneurship : conceptos, teoría y perspectiva (p. 21). Universidad Complutense de Madrid. [ Links ]

Cupani, M. (2012). Análisis de ecuaciones estructurales: conceptos, etapas de desarrollo y un ejemplo de aplicación. Revista Tesis, 1, 186-199. http://www.revistas.unc.edu.ar/index.php/tesis/article/download/2884/2750 [ Links ]

De la Fuente, S. (1999). Análisis de componentes principales. Proyecto E-Math Financiado Por La Secretaría de Estado de Educación y Universidades (MECD), 141-151. https://doi.org/10.1016/j.infsof.2008.09.005 [ Links ]

Di Masso, M., Ezquerra, S., & Rivera, M. (2021). Mujeres en la economía social y solidaria: ¿alternativas socio-económicas para todas? In CIRIEC-Espana Revista de Economia Publica, Social y Cooperativa (Issue 102). https://doi.org/10.7203/CIRIEC-E.102.17557 [ Links ]

Diez, S., Vargas, M. A., & Fernández, P. (2021). Factores incidentes en la creación de una unidad de negocios para graduados. Contaduria y Administracion, 66(2), 1-23. [ Links ]

Durán, J. A. E., & San Martin, J. M. R. (2013). Estudio comparativo de la empresa familiar en México en el contexto mundial. Revista de Estudios En Contaduría, Administración e Informática, 2(5), 21-54. [ Links ]

EOI, E. de N. de A. (2006). Factores que influyen en la creación y consolidación de empresas en Andalucía (p. 99). EOI Escuela de Negocios. [ Links ]

Escandon, D. M., & Hurtado, A. (2016). Influencia de los estilos de liderazgo en el desempeño de las empresas exportadoras colombianas. Estudios Gerenciales, 32(139), 137-145. https://doi.org/10.1016/j.estger.2016.04.001 [ Links ]

Escandón, D. M., & Hurtado, A. (2014). Factores que influyen en el desarrollo exportador de las Pymes en Colombia. Estudios Gerenciales, 30(131), 172-183. https://doi.org/10.1016/j.estger.2014.04.006 [ Links ]

Escobedo, M. T., Hernández, J. A., Estebané, V., & Martínez, G. (2016). Modelos de ecuaciones estructurales: características, fases, construcción, aplicación y resultados. Ciencia & Trabajo, 18(55), 16-22. https://doi.org/10.4067/S0718-24492016000100004 [ Links ]

Figari, C. (2019). La pedagogía empresarial en la consolidación hegemónica: un debate silenciado. Espacios En Blanco, Revista de Educación, 1, 145-160. [ Links ]

Foncubierta, M. J., Galiana, F., & Galiana, M. del M. (2020). Cámaras de comercio: una nueva gestión. El enfoque de cuadro integral en las cámaras españolas. In CIRIEC-Espana Revista de Economia Publica, Social y Cooperativa (Issue 99). https://doi.org/10.7203/CIRIEC-E.99.14602 [ Links ]

Franco, M. Á., & Urbano, D. P. (2010). El éxito de las Pymes en Colombia: un estudio de casos en el sector salud. Estudios Gerenciales, 26(114), 77-96. https://doi.org/10.1016/S0123-5923(10)70103-0 [ Links ]

García, J. J., León, J. de D., & Nuño, J. P. (2017). Propuesta de un modelo de medición de la competitividad mediante análisis factorial. Contaduría y Administración, 62(3), 775-791. https://doi.org/10.1016/j.cya.2017.04.003 [ Links ]

García, M. Á. (2011). Análisis causal con ecuaciones estructurales de la satisfacción ciudadana con los servicios municipales. In Proyecto fin de máster (p. 125). [ Links ]

Hayton, J. C., Allen, D. G., & Scarpello, V. (2004). Factor Retention Decisions in Exploratory Factor Analysis: a Tutorial on Parallel Analysis. Organizational Research Methods, 7(2), 191-205. https://doi.org/10.1177/1094428104263675 [ Links ]

Hernández, R., Fernández, C., & Baptista, P. (2014). Metodología de la investigación. In Mc Graw Hill - Interamericana (Vol. 53, Issue 9). https://doi.org/10.1017/CBO9781107415324.004 [ Links ]

Ibarra, M., González, L., & Demuner, M. de R. (2017). Competitividad empresarial de las pequeñas y medianas empresas manufactureras de Baja California. Estudios Fronterizos, 18(35), 107-130. https://doi.org/10.21670/ref.2017.35.a06 [ Links ]

INCYDE, F. y C. de C. de E. (2001). Factores para consolidar una empresa (p. 178). Unión Europea Fondo Social Europeo. [ Links ]

Jurado, I. M. (2018). Proyéctate: articulación Universidad-Estado-Empresa trabajando por la consolidación empresarial. 2(4). [ Links ]

Kasparian, D., & Rebón, J. (2020). La sustentabilidad del cambio social. Factores positivos en la consolidación de las empresas recuperadas por sus trabajadores en la Argentina. CIRIEC-Espana Revista de Economia Publica, Social y Cooperativa, 98, 213-246. https://doi.org/10.7203/CIRIEC-E.98.13940 [ Links ]

Lara, A. (2014). Introduccion a las ecuaciones estructurales en AMOS Y R (p. 72). https://es.slideshare.net/germanneiravargas/introduccion-a-las-protecciones-electricas [ Links ]

Leenen, I. (2012). La prueba de la hipótesis nula y sus alternativas: revisión de algunas críticas y su relevancia para las ciencias médicas. Investigación En Educación Médica, 1(4), 225-234. [ Links ]

López, L. M. P., & Calderón, H. G. (2006). Análisis de las dinámicas culturales al interior de un clúster empresarial. Estudios Gerenciales, 22(99), 13-37. [ Links ]

Martínez, M., & Martínez, Á. R. (2008). Sistemas de gestión de calidad y resultados empresariales: una justificación desde las teorías institucional y de recursos y capacidades. Cuadernos de Economía y Dirección de La Empresa, 11(34), 7-30. https://doi.org/10.1016/S1138-5758(08)70051-3 [ Links ]

Mavrou, I. (2015). Análisis factorial exploratorio: cuestiones conceptuales y metodológicas. Revista Nebrija, 19. [ Links ]

Melo, M., Bedoya, D., Reyes, C., & Borray, C. (2021). Desarrollo , creatividad e innovación : factores para la creación de un centro de desarrollo empresarial. Revista Ibérica de Sistemas e Tecnologias de Informação, E39, 341-354. [ Links ]

Mera, M. C., Terán, A. T., Berrera, D. M., Gomajoa, H. A., & Rojas, J. F. (2018). Importancia de los enfoques cooperativos en el desarrollo empresarial de algunas compañías hispanoamericanas exitosas. Revista Escuela de Administración de Negocios, 86, 169-184. [ Links ]

Morales, M. A. S., & Segoviano, L. E. C. (2016). Una perspectiva económico-institucional de la toma de decisiones: solución de problemas en situación de incertidumbre. Investigación Económica, 75(298), 57-75. https://doi.org/10.1016/j.inveco.2016.11.002 [ Links ]

Pazmiño, G., Valencia, M., Chacha, H., Hurtado, K., & García, M. (2018). Perspectivas del emprendimiento empresarial en el Siglo XXI. Mikarimin, Revista Científica Multidisciplinaria, 4(3), 25-32. [ Links ]

Pedrosa, I., Suárez, J., & García, E. (2014). Evidencias sobre la validez de contenido: avances teóricos y métodos para su estimación. Accion Psicológica, 10(2), 3-20. https://doi.org/10.5944/ap.10.2.11820 [ Links ]

Plaza, J. J. A. (2015). La innovación en el ámbito de la supervivencia y consolidación de nuevas empresas. In Intergovernmental Panel on Climate Change (Ed.), Universidad de Málaga (Vol. 1, pp. 1-30). Cambridge University Press. https://doi.org/10.1017/CBO9781107415324.004 [ Links ]

RAE. (2014). Real Academia de la Lengua Española. http://www.rae.es/ [ Links ]

Rodríguez, J. R., & Dussán, C. (2018). La informalidad empresarial, evolución literaria que denota un fenómeno complejo. Polo Del Conocimiento, 3(8), 561. https://doi.org/10.23857/pc.v3i8.655 [ Links ]

Rubio, M. J., & Berlanga, V. (2012). Cómo aplicar las pruebas paramétricas bivariadas t de Student y ANOVA en SPSS. Caso práctico . Revista d’Innovació i Recerca En Educació, 5, 83-100. https://doi.org/10.1344/reire2012.5.2527 [ Links ]

Sanchis, J. R. P. (2001). Creación y consolidación de empresas mediante el crecimiento en red: su aplicación al desarrollo local. Revista D-O, 25. [ Links ]

Silveira, Y., Cabeza, D., & Fernández, V. (2015). Emprendimiento: perspectiva cubana en la creación de empresas familiares. Investigaciones Europeas de Dirección y Economía de La Empresa, 22(2), 70-77. https://doi.org/10.1016/j.iedee.2015.10.008 [ Links ]

Terapuez, E. C., & Botero, J. J. V. (2007). Algunos aportes de los neoclásicos a la teoría eel emprendedor. Cuadernos de Administración, 20(34), 39-63. https://doi.org/10.1016/j.aprim.2011.07.019 [ Links ]

Texis, M. F., Ramírez, M. U., & Aguilar, J. G. B. (2016). Microempresas de base social y sus posibilidades de supervivencia. Contaduría y Administración, 61(3), 551-567. https://doi.org/10.1016/j.cya.2015.04.001 [ Links ]

Urbano, D. P., Díaz, J. C. C., & Hernández, R. M. (2007). Evolución y principios de la teoría económica institucional: una propuesta de aplicación para el análisis de los factores condicionantes de la creación de empresas. Econstor, 13(3), 183-198. [ Links ]

Valenciano, J., & Uribe, J. (2009). Emprendimiento de la economía social y desarrollo local: promoción de incubadoras de empresas de economía social en Andalucía. CIRIEC-España, Revista de Economía Pública, Social y Cooperativa, 64, 5-33. [ Links ]

Vílchez, C., Rojas, A., & Huapaya, A. (2019). Capacitación, remuneración promedio e impuestos como factores que explican la actitud hacia la regulación laboral en contextos de informalidad. Contaduría y Administración, 65(1), 152. https://doi.org/10.22201/fca.24488410e.2019.1790 [ Links ]

Williamson, O. E. (1985). Employee ownership and internal governance: A perspective. Journal of Economic Behavior & Organization, 6(3), 243-245. [ Links ]

Ynzunza Cortés, C. B., & Izar, J. M. (2020). Las motivaciones , competencias y factores de éxito para el emprendimiento y su impacto en el desempeño empresarial. Un análisis en las MIPyMES en el estado de Querétaro, México. Contaduría y Administración, 66(1), 1-22. https://doi.org/10.22201/fca.24488410e.2021. [ Links ]

1Although financing has little influence, this factor had to be maintained in order to achieve an acceptable adjustment of the structural model (author's note).

2This article is derived from the doctoral thesis Factores determinantes de la consolidación empresarial: un enfoque integrador entre el emprendedor, la empresa y el entorno (Determining factors of business consolidation: an integrating approach between the entrepreneur, the company, and the environment), to qualify for the degree of Doctor in Administrative Economics awarded in 2020 by the Universidad para la Cooperación Internacional México UCIMÉXICO.

Received: July 06, 2020; Accepted: February 24, 2022

texto en

texto en