The worst thing that can happen in the name of science...

is when the system becomes all-important.

We always looked for the element of crime in society.

But why not look in the very nature of man?

Lars von Trier (1984) The Element of Crime

Introduction

It has been documented that lower levels of violence in Latin America would lead to more capital accumulation and, in turn, generate increased growth and GDP per capita throughout the region (BBVA Research, 2010). Several approaches explain the relationship between high violence and low economic growth. Mehlum et al. (2005) offer a poverty-trap model that directly incorporates criminal activities into the analysis. According to this model, criminal activities lead to insecurity, which incur protection costs that impede greater economic growth. This model assumes that profitability is a determinant of economic activity to the extent that crime implies greater costs or lower expected returns and thereby reduces economic growth.

From the dominant perspective, entrepreneurs invest to generate profits. Financing costs and potential profits are two relevant determinants of investment decisions. The relationship between investment and the first determinant is negative because lower investment leads to costlier financing, whereas the relationship between investment and the second factor is positive because more investment will increase potential profits, similar to the sequence of events that occurs in growing economies. However, other factors, such as uncertainty and the state of public insecurity, are necessary to fully explain investment decisions. In particular, Robert Barro’s model serves as a basis for evaluating the economic impact of violence (Brunetti et al., 1998) such that the economic factors can be differentiated or isolated from the factors associated with violence.

In a global survey, Brunetti et al. (1998) confirm that entrepreneurs invest below their optimal levels because of a lack of credibility regarding law enforcement. In particular, this lack of credibility pertains to the subjective variables that determine the degree of uncertainty faced by entrepreneurs. Just as crime could explain declining levels of economic activity, the existence of crime and violence can also be explained using economic variables. In fact, public insecurity has a similar level of explanatory power, which shows that a weak internal market limits economic growth (Banco de México, 2010-14). Using municipal data, Robles, et al. (2013) found substantial negative effects due to violence on labor market participation, unemployment, decision to start a company, and income; they claim that in Mexico the growing rivalries between drug trafficking factions have resulted in an unprecedented increase in the levels of violence.

A more eclectic quantitative study about the causes of violence in South America (Salama, et al., 2007) tests separately the impact of economic variables on homicides, on one hand, and growing urbanization and inequality, on the other. This evidence is consistent with the association between high crime rates and low confidence in the police found in rapidly growing Latin American cities (Gaviria and Pagés, 2002). Unlike Salama et al. (2007), we did not explore variants of the crime conventional approach, but we found helpful the comparison of our estimates with theirs.

The dominant economic model for analyzing criminal activity was proposed by Gary Becker. Becker assumes that criminal conduct is rational, but he also recognizes that people have moral and ethical constraints and do not always commit crimes, even though crime may benefit them, and the risk of being caught may be negligible (Becker, 1993). Just as scholars do, we focus on the notion that certain individuals become criminals because there are more financial benefits (or other types of benefits) to crime than legitimate work, even when considering the probability of being caught and the severity of the resulting punishment. According to Eide (2000: 363), it has been difficult to analyze statistically ethical and moral constraints, probably because of the limited variability between statistical units that make it hard to produce precise estimates.

The above mentioned approach suggests that the economic variable that explains criminal activity is income or wealth inequality because greater inequality leads to greater financial benefits from criminal behavior. Although this link exists between inequality and crime, there are other non-economic factors that are also interacting with one another. Becker (1993) himself explains that “the amount of crime is not only determined by rationality and preferences of those who might become criminals but also by the economic and social environment created by public policy”. Göran Holmqvist (2000) discusses various social aspects that could be correlated with income inequality and that could provide the link between inequality and crime. For example, this researcher proposes that a society with a high concentration of income would probably also have wide swaths of marginalized and underserved populations. In particular, greater inequality translates into greater financial benefits to be gained from criminal activity. In addition, the low moral thresholds of certain people (i.e., a general belief that the egalitarianism of the society has been violated) coupled with a combination of the aforementioned factors and rising inequality would promote higher crime rates.

There could be evidence of a lower moral threshold in Mexico after 2008, when there was a disruption in violence. Indirect data taken from Latinobarómetro suggest a change in dissatisfaction with democracy. Those “somewhat satisfied” and “not satisfied” with democracy increased 3.1 percentage points from 73.5% to 76.6%, from 2004-2007 to 2009-2011. There was also an increase in those who answered that “Mexico is governed for the benefit of the powerful” from 76.3% to 79.6% (+3.3 percentage points) in the same periods. These components are difficult and costly to collect in a quarterly data basis. As far as we know, this kind of information is not available. Therefore, our estimate focuses on economic variables and sentencing rates.

This article intends to 1) explain the high rate of homicide in Mexico and 2) estimate the impact of violence on the economy. The remainder of the article is structured in four sections. First, the study presents an economic model to explain the variation in criminal activity. The estimates and results are then demonstrated, and the impact of crime on salaries and employer rates is then assessed. The article concludes by showing that there is evidence to support the Beckerian hypothesis for the factors that promote and inhibit criminal activity in Mexico.

The Economics of Crime

Multiple attempts grounded in economic theory have been made to explain criminal activity using the principles of rationality, equilibrium and efficiency. A person’s decision to participate in legal pursuits or criminal activity is a response to incentives based on income opportunities that are both formal and criminal, as well as by sanctions stipulated by the judiciary. The purpose of using economic tools is to determine the efficacy of various anti-crime policies. This economic explanation does not evaluate issues of morality to explain why some people commit crimes and others do not.

Broadening the perspective from the individual to a general equilibrium scheme allows for a comprehensive economic explanation of the determining factors behind criminal activity. It is assumed that a given individual selects the action that gives him the greatest expected outcome between legitimate work and crime (Laing, 2011).3 Crime is individually rational when EU 0 > EU 1, where EU 0 is the outcome from choosing crime and EU 1 is the expected outcome from formal employment; substituting EU 0 and EU 1 , crime is a valid option if

where π is the probability that a criminal is captured committing a crime. The criminal with the probability 1-π is not apprehended and enjoys a profit of $α; with the probability π, the criminal is caught and his outcome is U(α-s), where s captures the severity of the legal sanctions. EU 1 = U (w) captures the opportunity cost of crime. The greater an individual’s aversion to risk, the greater the weight he places on the bad outcome, U(α-s) [Laing, 2011].

Equation (1) establishes that greater remuneration w from formal employment can inhibit crime. Other variables that might stop crime are an increase of π or s. However, an increase in profit (loot) α promotes an increase in criminal activity.

From a general equilibrium perspective, the actions of individuals are assumed to be rational and consistent in the aggregate (Laing, 2011). Because people can choose from various activities, the aggregate population N is the sum of individuals who work a legal job (L) and those who participate in criminal activity (C), where N = L + C. For simplicity, it is assumed that a situation of risk neutrality is observed, where (U)x = x, which implies that people make decisions based on their expected consumption levels.

A net profit function is used to determine the model equilibrium as follows:

(2)

G = EU 0-EU 1 =α - π · s-w

Equilibrium is achieved when G = 0, which means that there are no incentives to change activities because the net profit from crime is exactly zero. Assuming that the values of α, π and s are provided, the function G is equal to zero when w is at a certain employment rate level L 0* (Laing, 2011). Outside of equilibrium, if G > 0, there will be individuals seeking to participate in criminal activities that provide a greater income. The incentive will be increasingly reduced as less formal employment provides increases of w. If G < 0, individuals prefer formal employment that provides greater income than crime; thus, a greater volume of employment will place downward pressure on salaries until equilibrium is reached at G = 0.

In a comparative statics analysis, a shift of the labor demand to the right, due to technological progress or the creation of new companies, will result in G > 0 because there will be higher salary levels at any employment level resulting in the convergence to another equilibrium level. This new equilibrium is more desirable because there are higher employment levels relative to criminal activity in comparison with the initial equilibrium.

Data Description

The main variable of interest is the number of homicides per 100,000 inhabitants (μ). This indicator is constructed with data from the Mexican National Institute of Statistics and Geography (INEGI, by its acronym in Spanish). The following three explanatory variables were obtained from the employment survey performed by INEGI: unemployment rate (u), average monthly salary (w) adjusted to constant 2010 prices, and gross labor participation rate (% Economically Active Population/Total Population), which was named y it to denote that this is an indicator of economic activity. The Becker effect (π) was the proportion of convictions per homicide.

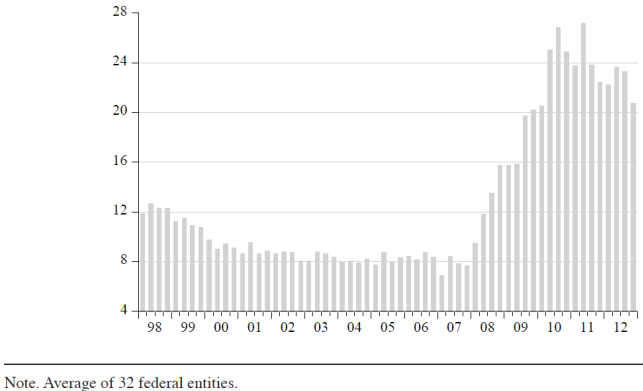

Table 1 shows the mean values of the variables used in the dynamic panel estimate. The values correspond to the 2005-2012 period, which covers two stages. The first stage corresponds to a relatively stable number of homicides per 100,000 inhabitants, and the second stage corresponds to high homicide rates (Figure 1). The estimations incorporated a broader time horizon covering the 2001-2012 period.

Table 1 Descriptive statistics of the selected indicators within Mexico

| Homicide rate μ | Participation rate (%) y | Sentencing rate π | Log of wage w | Unemployment rate (%) u | ||

| 2005-2007 | Mean | 8.10 | 42.03 | 8.08 | 3.73 | 3.28 |

| 2010-2012 | Mean | 23.70 | 43.51 | 3.41 | 3.69 | 4.99 |

| 2005-2012 | Mean | 15.74 | 42.80 | 5.61 | 3.71 | 4.20 |

| Median | 9.52 | 42.36 | 3.85 | 3.70 | 3.99 | |

| Maximum | 223.52 | 51.77 | 200.94 | 3.96 | 9.61 | |

| Minimum | 0.09 | 34.22 | 0.05 | 3.46 | 0.73 | |

| Std. Dev. | 20.50 | 3.19 | 8.46 | 0.09 | 1.67 |

Source: Authors’ research results are based on INEGI data, mortality statistics and employment survey. Sentencing rate (π) is the proportion of convictions to homicides.

Source: INEGI data on deaths caused by homicide.

Figure 1 Homicides per 100,000 inhabitants in Mexico

The effects on three explanatory variables are estimated to assess the impact of crime (Table 6): a) salaries, b) the employer rate per 1,000 inhabitants (based on the employment survey performed by INEGI), and c) mortgages per person classified within the economically active population, with the credit amount expressed in constant 2010 prices (based on information from the Bank of Mexico).

Estimation and Results

The proposed econometric exercise is designed to explain the evolution of violence in Mexico based on economic variables. The homicide rate shows a major rebound in 2008 (Figure 1). Capturing the phenomenon of violence through statistics is not a simple task. Salama and Camara (2007) have provided warnings of the difficulties of measuring various facts and degrees of violence and indicated that there are problems with collecting and documenting the same event. One way to successfully resolve these difficulties is to use the homicide rate as a proxy for violence, which is generically referred to in the literature as crime (Greenberg, 2001; Holmqvist, 2000). Thus, the homicide rate per 100,000 inhabitants is used as a proxy for crime.

Two characteristics are central to criminal activity: important seasonal variations and notable differences in crime, although some regions have apparently similar economic characteristics (Laing, 2011). The method of panel estimation can help solve this problem. An estimation of the model parameters according to Equation (3) is of particular interest in the present case.

where i = {1,...,32}, and t ={1,...,T}. By construction, μ it-1 is correlated with the unobserved individual-level effect u i . The model is expressed according to first differences by using instrumental variables to avoid inconsistent estimators. The generalized method-of-moments (GMM) estimators are applied because there are more instruments than parameters. The estimate is used according to the proposition by Arellano and Bond (1991), in which moment conditions are created using lagged levels of the dependent variable with first differences of the errors ϵ it , and the first differences of strictly exogenous covariates are also used to create moment conditions.

It is assumed that the labor participation rate is a predetermined regressor because it is possible that ϵ it may affect x it when s > t. Furthermore, it is assumed that the sentencing rate is an endogenous variable because factors explaining the homicide rate by design also impact the sentencing rate. All necessary instruments were used to achieve an efficient estimate. The estimator recognizes that if the autoregressive process is too persistent, then the lagged-levels are weak instruments. Thus the necessary instruments were provided on the assumption of no serial correlation. Stata’s Arellano-Bover/Blundell-Bond estimator uses additional moment conditions in which lagged differences of the dependent variable are orthogonal to levels of the disturbances (Drukker, 2008). To obtain these additional moment conditions, they assumed that panel-level effects are unrelated to the first observable first difference of the dependent variable.

The empirical equation is as follows:

where i is the index for the federal entity, t is the time index, μ is the homicide rate per 100,000 inhabitants, π is the proportion of convictions to homicides, y is the gross labor participation rate, w is the logarithm of mean salaries, u is the unemployment rate, d i captures a fixed effect, and ϵ it is the random term in the equation.

There is a high persistence of homicide rates. The parameter γ = 0.873 indicates that 87.3% of the homicide rates in t+1 depend on the value observed in t. The existence of a strong inertia process justifies the dynamic panel estimate. Contrary to expectations, the high rate of persistence did not halt the increasing homicide rate, which multiplied by a factor of 3.5 between 2007 and 2010, achieving rates well above those observed in previous years. Each year, the homicide rate increased by 2.96 points between 2007 and 2012.

Table 2 Estimated coefficients

| Response of homicides to an impact from: | |||||

| Auto-regressive term γ | Economic activity β 1 | Becker effect β 2 | Salaries β 3 | Unemploy-ment rate β 4 | |

| Coeff. | 0.873 | 0.232 | -0.129 | -3.410 | 0.484 |

| s. e. | 0.043** | 0.072** | .042** | 3.574 | 0.250* |

Note: ** ρ < 0.01, *ρ< 0.06. Stata GMM system estimator. Robust std error. Arellano-Bover/Blundell-Bond linear dynamic panel-data estimation. Predetermined variable: y = labor participation rate. Endogenous regressor: π. The constant term of the equation is not reported. Number of instruments: 1700.

The estimated equation closely reproduces the evolution of the homicide rate. Table 1 shows the mean values for the entire period as well as a comparison of the homicide rate in the stable stage of 2005-2007 with that of the high rates observed in 2010-2012. In each of the comparisons, the prediction is close to the value reported by the statistical office (see Table 3). Apart from the significance of the autoregressive term (μ it -1), the increase in crime can also be explained by the economic activity (y it ) and the sentencing rate (π it ). According to the theory, an increase in economic activity (i.e., the gross labor participation rate) represents a greater amount of resources that can be stolen by means of illicit activities. This positive relation was verified with β 1 = .232, with each percentage point of increased economic activity leading to an approximate increase of 1/4 of a point in the homicide rate. In addition, it could be expected that an increase in the standard error of the sentencing rate σ π = 8.46 will reduce the homicide rate by 1.09 points.

Table 3 Model fit. Homicide rate prediction

| Mean | Actual | Fitted |

| 2005-2012 | 15.74 | 15.76 |

| 2005-2007 (a) | 8.10 | 8.46 |

| 2008-2009 | 15.27 | 14.47 |

| 2010-2012 (b) | 23.70 | 23.91 |

| (b)-(a) 2010-12/2005-07 | 15.59 | 15.45 |

Source: Authors’ research based on panel data estimates.

The panel estimate does not indicate that the mean salaries had a statistical significance. The profits of crime and opportunity costs are denoted as monetary variables in the theory. Moreover, the estimate quantifies the significant variables in terms of volume, such as the gross labor participation rate and unemployment rate. The variations of output and salaries per person were not able to describe properly the changes in the homicide rate of Mexico.

A method of preventing increases in violence is to prevent increases in the unemployment rate because the estimates reveal a direct but weak link (p = 0.054) between unemployment and violence. Assuming that β4 = 0.484 is valid, each percentage point decrease in the unemployment rate would reduce the homicide rate by approximately half a point. The relevance of the unemployment rate for explaining criminal activity is reported in Gould et al. (2002, cited in Laing, 2011). The evidence mentioned by the authors is the decrease in property crimes in the 1990s, which occurred because of a significant decrease of the unemployment rate in the United States. Their estimate shows that when the unemployment rate is reduced by 1.0%, crimes were reduced by 2.2%. In another study (Haddad et al., 2011) with panel data on Iran, an increase of 1.0% in the unemployment rate was reported as increasing burglaries by 0.13%. These numbers allow us to contextualize our findings on unemployment and crime in Mexico and show that our results are consistent with international results.

From 2007 to 2010, the homicide rate increased by 15.59 points. This significant increase could be explained by an increased rate of gross labor participation rate and possibly by an increased unemployment rate (see Table 1 and the final row of Table 3). Violence also increased as a result of reductions in sentencing rates caused by the following two trends: increased number of homicides and decreased number of convictions. Taken together, the country had less of a capacity to process criminal acts, which statistically confirmed the increased number of crimes committed.

The panel, which was estimated for the complete period from 2001 to 2012 and is verified in Table 3, closely describes the evolution of the homicide rate. Comparisons within the sample period have a lower performance. When crime acceleration (ca. 2009) is compared with the stable period from 2005-2007, the prediction tends to underestimate the observed value of homicides. The opposite result (overestimation) is obtained when comparing the period of high homicide rates (ca. 2011) with the transition period from 2008-2009 (see Figure 1). This model limitation appears to be lower because it manages to successfully capture the rapid transition from low homicide rates in 2007 to high homicide rates in 2012 (Table 3).

The results of the estimation suggest that increased economic activity induces higher criminality rates, which is explained by the theory as being related to an increased potential to obtain illicit profits. The present study also found that the Becker effect is an effective deterrent of increased criminal activity. To counteract the rise in criminality, the sentencing rate should rise at a sufficient speed to create a demonstration effect that indicates a lack of tolerance for crime by the judiciary. Unfortunately, the wave of violence in Mexico after 2008 occurred simultaneously with a decreasing trend in the number of convictions. The estimate indicates that it is possible to achieve economic growth with a controlled level of violence if and only the judiciary system is able to efficiently process criminal offenses.

In South America, Salama and Camara (2007) estimates by groups of countries revealed that a higher gross domestic product (GDP) could increase or reduce criminality (Table 4). The Mexican case shows that economic activity has a positive effect on the homicide rate. Mexico resembles Bolivia and Colombia, two countries that have high levels of violence and are major drug producers. For the group formed by Argentina and Uruguay, the GDP per capita has a negative effect on homicides, perhaps because these countries possess high human development indicators and high rates of secondary schooling. Finally, the GDP per capita in Brazil and Chile has no significant effect on the homicide rate. These two countries have more efficient judicial systems, and Brazil stands out for its high level of income inequality (Salama, et al., 2007: 62). Therefore, based on the comparison between Mexico and South America, economic growth is not shown to have a definitive one-way effect on crime. The evidence indicates that context has a decisive influence on the relationship between the economy and violence.

Table 4 Comparison of estimates of income elasticity in relation to the homicide rate.

| Mexico | South America* | Bolivia and Colombia | Argentina, Chile and Uruguay | Brazil and Chile |

| 0.729 | -1.72 | 0.59 | -0.30 | 0.16 |

| (-3.22) | (-3.06) | (-4.27) | (-1.81) | (n. s.) |

* n = 10 countries. Source: Salama and Camara (2007) except for Mexico, which was calculated by the author using labor participation instead of GDP. The t-statistics are shown in parenthesis. The sample of 10 countries in South America offers an estimate with the Beckerian effect; thus, the equation includes a variable that measures the effectiveness of the repression of crime, which is calculated as a percentage of the homicide cases solved with respect to the total number of homicides. After including this variable, the figure changes from -1.72 to -2.57, which is statistically significant at 1%.

Economic Consequences of Crime

The previous sections attempted to clarify the economic determinants of criminal activity, which is different from the impact of crime on the economy. Three performance variables were selected to determine the impact of crime on the economy: 1) mean salaries, 2) proportion of employers in the entire population, and 3) housing loans within a proportion of the economically active populations as a proxy for investment in capital goods. All three variables are used to provide a broad picture of the economic consequences of crime. The following specification was calculated:

where m = 1,2,3 according to the performance variable z in question, i is the index for the federal entity, t is the time index, μ is the homicide rate per 100,000 inhabitants, x represents a set of control variables, d i captures a fixed effect, and ϵ it is the random term of the equation.

A test for Granger causality in a panel framework. Given the standard Granger causality definition, for each section i ∈ [1,N], we say that the variable μ

i,t

is causing z

i,t

if we are better able to predict z

i,t

using all available information than if the information apart from μ

i,t

had been used. Hurlin and Venet (2001) consider a VAR representation, adapted to a panel data context. For each section i we have,

with v

i,t

= α

i

+ε

i,t

, where ε

i,t

are i.i.d.,

The introduction of a panel data dimension allows using both cross-sectional and time series information to test the causality relationships increasing the degree of freedom and reducing the collinearity among explanatory variables (Hurlin and Venet, 2001). The homogeneous non causality (HNC) test consists in testing linear restrictions on parameters

The Wald statistic is presented in Hurlin and Venet (2001). If we reject the null hypothesis of non-homogeneous causality (HNC), the more plausible is that some coefficients

Table 5 shows the results of the HNC hypothesis for the case of: 1) mean salaries, 2) proportion of employers, and 3) housing loans. For the Granger causality tests the concomitant Wald statistics are reported with the corresponding significance levels denoted by asterisks. The HNC hypotheses result in the following ways: 1) the hypothesis that homicide rate does not cause mean salaries is strongly rejected, irrespective of the number of lags included. Conversely, this hypothesis can be rejected only for three lags at the 10% significance level; 2) the hypothesis that homicide rate does not cause proportion of employers is rejected for lags two and three at 5% and 10% level, respectively. The opposite hypothesis

Table 5 Non-homogeneous causality test results

| Mean salaries | Proportion of employers | Housing loans | ||||

| Lags | μ ↛ w | w ↛ μ | μ ↛ L E | L E ↛ μ | μ ↛ H | H ↛ μ |

| 1 | 18.04*** | 0.21 | 1.95 | 2.39 | 3.47* | 14.55*** |

| 2 | 11.11*** | 1.14 | 3.01** | 1.51 | 1.67 | 7.16*** |

| 3 | 8.29*** | 2.51* | 2.51* | 1.20 | 1.71 | 4.73*** |

Significance is denoted by ***1%, **5%, and *10%. F-statistic reported. Cross-sections included: 32. Total panel (balanced) observations: 1536.

In sum, we can only determine economic consequences of crime on the first two variables (wage and employer rate). The Granger causality test does not support that crime causes housing loans, but the opposite. This evidence excludes housing loans as a measure of the crime impact.5

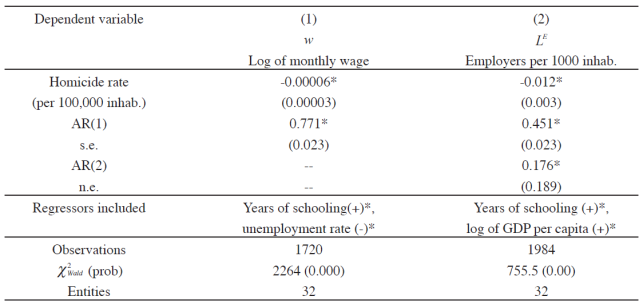

The estimate method is a dynamic panel, which was shown in the previous section; therefore, a robust variance-covariance matrix of the estimators is used such that the errors do not need to follow a normal distribution or be identically distributed from one observation to the next. This estimation is robust for a heteroscedasticity of errors (Stata, 2013). Table 6 shows the results of the homicide rate, which are based on the three chosen variables, as well as the parameters of the autoregressive terms. The first result shows that an increased homicide rate generates a small salary reduction; however, this result is not statistically significant. An increase equivalent to the standard deviation (20.50) in the homicide rate is estimated to reduce the mean salaries by approximately 0.13%. This estimate is consistent with that of Robles et al. (2013) in significance and negative value, although the magnitude reported by Robles et al. is many times higher than the results reported in Table 6. A possible explanation of this significant difference is that Robles et al. did not use control variables to isolate the effects of violence; thus, their estimate could have been affected by other factors that would have had an impact on the changes in salaries.

Table 6 Effects of an increase in the homicide rate on economic variables

Note: * p <0.05, standard errors are in parenthesis, n.s. = non-significant at 5%.

A second impact of the homicide rate is the reduction of the employer rate per 1,000 inhabitants, the hiring rate in exchange for an economic remuneration of money or in specie. An increase of the homicide rate by one standard deviation would lead to a reduction of the employer rate by a quarter of a point (0.254). Considering that the average population within the federal entities is 3.45 million, an increase in violence by one standard deviation would reduce the number of employers by 876 individuals. Researchers Robles et al. (2013) also found a negative relation (-0.04) between homicide rates and the employer rate, with their sample for Mexico containing municipal level data and converging on the 2001-2010 period.

Presumably, small national businesses will invest in safer assets rather than in the optimal projects for protection purposes. They face more limitations and uncertainty, and their investment decisions will be inefficient because the asymmetrical conditions of their environments will lead them to invest smaller amounts of capital (Brunetti et al., 1998). The effects of violence are associated with the alternatives available to people or organizations. Low-income segments of the population and small domestic companies have fewer alternatives such that changes in the safety of their conditions do not appear to substantially influence their decisions. For these populations and companies, the resource allocations could be inefficient, and the expected welfare conditions are lower in the medium and long term.

Another important distinction is found by comparing the options of foreign investors with the options available to domestic investors. Brunetti et al. (1998) argue that the alternatives of the domestic investors are bound to the organization’s immediate territory such that they have less available information and fewer resources. In contrast, larger companies and multinationals can compare the conditions of various countries and have the knowledge and resources needed to invest abroad. Likewise, large companies have more resources, which can be used to provide more protection and even to influence public budgets.

Conclusions

Violence in Mexico was studied using a Beckerian approach to specify the benefits and potential costs of a criminal. Empirical dependent variable was the rate of homicides and the main source of economic information was the employment survey. The results confirm that a growing economy tends to generate a higher rate of crime. In Mexico, the crime received an extra boost because the number of sentences decreased, while increased violence, reducing the probability of punishment for the benefit of offenders. Wages seen as a deterrent was not statistically significant. The impact of violence on wages, the rate of employers and housing loans were also estimated. Evidence suggests that a strategy to reduce crime could be articulated through the reduction of the unemployment rate and a higher rate of sentences.

It was observed that a reduction in violence would have a positive impact on the average wage and the rate of employers, in both cases, helps strengthen the local economy. In this paper it was assumed that all economic actors are equally likely to be victims of crime. There is evidence to hypothesize that the cost of crime is distributed asymmetrically. It requires further research to determine the welfare loss caused by the violence in Mexico.

nueva página del texto (beta)

nueva página del texto (beta)