Introduction

The retirement saving assets of the individuals play an important role both in the household economy and in the macroeconomic performance of a country. On the one hand, the amount of assets in a retirement account is an important factor for the financial stability of a person and his economic dependents in the retirement age; and on the other, the aggregate retirement saving substantially contributes to the national saving and creates the basis to boost investments and economic growth.

The studies of the determinants of retirement saving assets focus mainly on the individual level analysis, involving microdata and household surveys (Crossley, et al., 2017, Goda, et al., 2019). They are aimed at explaining retirement saving from different perspectives comprising variables such as whether the individual holds any retirement asset or account and the amount of retirement assets (Yang and De Vaney 2012), the amount of contributions (Kim, et al., 2017), and whether the person has a retirement saving contract, how much is saved and the individual gross saving rate (Metzger, 2017).

The explanatory variables incorporated in the analysis include different sets of characteristics at the household or individual level (Yusof and Sabri, 2017), among them stand out financial literacy and risk preferences (Rey-Ares, et al., 2015), planning horizons decisions (Rey-Ares, et al., 2018, Rolison, et al., 2017), immigration status (Fontes, 2011), health related issues (Giovanis and Ozdamar, 2018), demographic features (Börsch-Supan, 2015), and behavioural and physiological features (Rolison, et al., 2017). However, only a few studies have addressed the macro determinants of aggregate retirement saving or the financial conditions of pension plans (Barth, et al., 2018).

The study of the case of Mexico is particularly relevant because the average balance in the retirement accounts in constant prices has hardly increased over the last few years, between 2011 and 2018 the figure practically did not rise, it remained steady. In the last two years, between 2019 and 2020, the average balance has started to increase, but the resource in the accounts remains low in average; in December 2020 it was around $4,690 US dollars. Under these circumstances, future retirement age income, for individuals who currently are economically active, looks precarious, which is a factor that will not benefit the persistent levels of poverty in the population. Moreover, there is little awareness and culture of saving for retirement in Mexico, mainly among young people, (Alvarado Lagunas and Duana Ávila, 2018) find that a high proportion of them save, but few do so for the long-term or thinking on their retirement.

In addition, the studies involving the relationship between pension funds and macroeconomic variables tend to focus on developed countries (Ashok, et al., 2014, Alda, 2017, Holzner, et al., 2019), and although research has also been conducted on developing countries (Ofori-Abebrese, et al., 2017, Lisenkova and Bornukova, 2017), to our best knowledge, the macroeconomic determinants of founds in retirement accounts have not been explored yet for the case of Mexico; hence, this paper provides important insights in the topic.

The relevant literature mostly concentrates on the analysis of the relationship between macroeconomic variables and aggregate pension funds, but usually it does not address the average balance on the individual pension plan account as the dependent variable. For an emerging economy like Mexico this is an important topic because, to the extent that the average resource in the account increases, there will be more bases to reduce poverty among the aged population, and to increase gross saving to support national investment and growth.

In this context, the study has two main objectives: the first is to identify the macroeconomic determinants of the average balance in retirement accounts. The second is to identify the relevance of the determinants to explain the behaviour of the dependent variable, in terms of causality, magnitude and direction of the effect, long-run relationship, and share in variation. Through these objectives we are aimed at having a better understanding of the behaviour of average saving in retirement accounts and its macroeconomic causes, to provide new insights in the topic and to formulate some policy implications.

The analysis considers data from all those persons who take part in a social security system in Mexico, in turn are included in the retirement saving system, and hold an individual account in any retirement funds agency (AFORE). In this study we conduct multivariate time series analysis applying Vector Autoregressive (VAR) models. The method regresses a variable on itself and on a vector of explanatory variables using one or more lags. The study applies a monthly dataset consisting of 144 observations, over the period comprising January 2009 to December 2020. This methodology is appropriate to explore long-run relationship and causality among the variables, the patter of the response on a variable to an impulse on a vector of variables, and contributions from explanatory variables to the variation on a dependent variable, and hence, provides appropriate features to achieve the objectives. Moreover, a theoretical discussion is conducted to justify the incorporation of the variables in the study and to formulate a hypothesis.

Our findings are that variables such as real wage and the stock market have a direct benefit on the average saving in the retirement accounts, the aging and the proportion of the economically active population also benefit average retirement saving. The conditions of employment must improve if they are to provide a benefit. The economic activity exerts an indirect benefit transmitted through real wage and employment. The main finding is to find that improvement to the pension system does not relay only on changes of the parameters of the system itself, but also on macroeconomic factors.

The paper also contributes to explore how macroeconomic variables can benefit or affect retirement saving of individuals in an emerging market such as Mexico and provides new insights in the study of macroeconomic determinants of retirement saving, which is a topic that has barely been studied in emerging economies.

The paper is organised as follows: in the first section it is discussed the theoretical background supporting the study and a hypothesis is formulated, in the second section the multivariate time series analysis is developed, in the third section some comments on the results are pointed out, finally, in the last section conclusions and policy implications are provided.

II. Theoretical background

The factors that directly influence saving, and in particular the balance in an individual retirement account, in a pension system consisting in defined contribution, like that mostly operating in Mexico, are diverse. In this study we identify and explore three of them, due to their relevance: The real wage of the employee, because the contribution from every person is determined by a factor previously defined, equivalent to a percentage of the wage; hence, it is expected that the larger the wage the more the balance increases. The age of the person is also associated positively to the balance in retirement accounts because contributions increase along the years. The stock market index, because retirement funds are partially invested in the stock market; the effect might be ambiguous since in times of fall, the financial operators of the AFORES could take advantage of this and obtain higher returns, but in times of rise, higher returns are also expected. The direction of the effect also depends on additional factors such as the percentage invested in the stock market, the regulations to limit risks, the time perspective of the investments or the internal policy of the AFORE.

Behind these variables there is a theoretical background explaining their effect on retirement saving. Regarding the household or individual income, the absolute income hypothesis of Keynes (1936) points out saving as the balance of disposable income after discounting consumption, it takes the absolute level of disposable income as an important determinant of saving. The hypothesis depicts saving as a positive linear function of income, plus other variables such as wealth and interest rate, with a positive intercept. The relative income theory (Duesenberry 1949) contributes to the Keynesian theory of income by associating saving to relative disposable income and not only to absolute disposable income, because people tend to compare their income with other people in their community to perform economic decisions. This habit transforms the people´s income relative to those in the community into a determinant of their saving and consumption rates. (Harris, et al, 2002).

Friedman´s permanent income hypothesis assumes that households or individuals are rational and will accumulate or save and then decumulate assets to maximise lifetime utility function (possibly including bequest); the permanent income corresponds to those factors determining the capital value of wealth: the nonhuman wealth, the personal attributes of the earners, and the attributes of the economic activity of the earners (Friedman, 1957). The hypothesis assumes that savers have the cognitive ability to solve the necessary optimization problem and have sufficient willpower to execute this optimal plan (Benartzi and Thaler, 2007, Yusof and Sabri, 2017). The consumption of individual is determined by current and expected income, the individuals optimise consumption over time in a way that they can keep saving for retirement. The individual plans saving for the future, being an important motive of saving the need to provide life necessities during retirement (Modigliani, 1986).

There is a tendency in the literature to highlights income as one of the main driving forces of saving and as a determinant of the decision to save for retirement, because higher income or wage leads to more economic resources to devote to pension funds (Fernández, et al., 2015, Torricelli, et al., 2016). We use the real wage as a proxy of income because real wage is the main income source of the employee and an important contribution factor for saving in the pension system. The variable is expected to have a positive impact on the balance of retirement accounts.

The effect of age on retirement saving is explained by the life-cycle theory. According to it, saving will increase during the working life as people approach retirement, to protect consumption and purchasing power from the labour income decline that will come at the time of retirement. The theory departs from the Keynesian argument, which states that a greater proportion of income is saved as real income increases, but incorporates additional factors determining the proportion of income saved, resting on two propositions: a) the major purpose of saving is to provide a cushion against variations in income occurring during the life-cycle of the household and short term fluctuations; b) the provision the household can afford to make for retirement and emergencies is proportional to its average earning capacity, but also to the numbers of years over which the provision can be made (Modigliani and Brumberg, 1954, Rey-Ares, et al., 2018). As the permanent income model, the life-cycle hypothesis, assumes that individuals and households are rational, maximise lifetime utility function and optimise consumption and saving.

To test the life-cycle hypothesis and the effect of age on retirement saving we use the age dependency ratio, following previous relevant studies (Dutta, 2017, Bidisha, et al., 2019, Tang, et al., 2020). The age dependency ratio measures the proportion of ‘dependent’ population (aged below 15 and above 65 years), generally they have no contribution in saving rather they dis-save, to ‘working age’ population (aged 15 to 64 years). According to the life-cycle hypothesis, it is expected to have a negative relationship with saving, because the smaller is the ratio the higher is the amount of working people, and therefore, there can be more accumulation of saving for retirement. Moreover, as the economically active population increase its average age, people in average have had more time to save for retirement.

Most of the theoretical and empirical literature, analysing the relationship between pension funds and the stock market, has found a positive influence between the two variables (Kim, 2010, Sun and Hu, 2014, Enache, et al., 2015, Bayar, 2016, Babalos and Stavroyiannis, 2020). The theoretical explanation behind these empirical results assumes important functions of institutional investors, in particular pension funds; these functions comprise the strengthening of long-term investments, risk controls, price volatility reduction, capital market integration at international level, financial instruments diversification, the intensification of competition, and the increase of financial innovation (Impavido and Musalem, 2000, Dayoub and Lasagabaster, 2008, Enache, et al., 2015). Although the literature points out the positive connection between pension funds and long-term saving and investments, there is a group of studies stressing that the aging trend might have a negative effect on the stock market, since the savers become more conservative over time (Bergantino, 1998, Poterba, 1998, Goyal, 2004, Alda, 2017).

Most of the studies in the relevant literature tend to explore the effect of pension funds on the stock market, in this paper we are aimed at analysing the impact through the opposite direction. The variable we use to proxy the local capital market is the stock market index in Mexico. Despite ambiguate in some arguments, we expect a positive effect of the stock market, as there is more evidence in this direction in the literature.

To test whether there is causality from the explanatory variables towards the dependent variable, granger causality tests are conducted.

Additional macroeconomic variables influence the average balance of the individual retirement accounts, but the effect is not direct. This is the case of the economic activity or GDP, an increase in this variable affects employment and therefore, impacts the pension system. However, the direction of the effect in the balance of individual retirement accounts is ambiguous, because on the one hand, economic growth might increase not only employment but also wage and thus, it produces more individual accounts and a higher amount of contributions; on the other, the new jobs created by economic growth might be low pay jobs, or jobs for young people who are new enters in the pension system, which causes a reduction of the average balance in the accounts. The growth in economic activity can cause additional disposable income in households, encouraging saving in the form of voluntary contributions to the retirement account. Overall, economic expansion affects employment and real wage and in turn, it is expected an ambiguous impact on individual retirement saving.

In theoretical terms, a vast number of postulates have explained the role of saving on GDP. The Harrod (1939) and Domar (1946) Keynesian growth model explains the role of saving and investment habits of households and firms to reach warranted economic growth and equilibrium in the economic system. Neoclassical economists pointed out instability in the model, due to the assumption that production takes places under conditions of fixed proportions -labor cannot be substituted for capital in production- when this assumption is abandoned the notion of balanced growth, which is understood as the steady state of the equilibrium growth path when the ratios among key variables are stable, vanishes (Solow, 1956). Instead, Solow proposes a long-run growth model, which takes all the Harrod-Domar assumptions except that of fixed proportion; the model highlights the role of saving to boosts per capita income and illustrates how saving becomes a factor to achieve steady state growth, under exogenous and standard neoclassical conditions. The endogenous growth theory abandons the assumption of exogeneity; authors such as Romer (1986) and Lucas (1988) underline the role of saving to promote capital formation, which allows a country to reverse diminishing returns of capital and achieve higher rate of growth.

The theory supports a positive effect of saving on growth. In this study we explore this relationship, but accounting the effect in the opposite direction, and focusing on the average retirement saving in individual pension accounts. In this context, the effect of growth on saving might be ambiguous as commented above. The proxy of economic growth used in this study is the general index of economic activity. We also incorporate employment and real wage variables to test whether economic growth works through these two variables or whether directly influences the retirement saving. The proxy of employment is the employees registered in the Social Security Mexican Institute (IMSS); we use this variable because it accounts for formal jobs registered in the retirement saving system holding an individual account in any retirement funds agency. The proxy of real wage is as commented previously.

Based on the theoretical and empirical discussion above, we formulate the following hypothesis: Real average wage and the stock market benefit average saving in retirement accounts, the effect of economic activity is transmitted through employment and real wage, but additional employment decreases the average retirement saving, the aging and proportion of economically active population benefits the dependent variable.

III. Methodological analysis

The methodology comprises the performance of a vector autoregressive model, in which the dependent variable is regressed on itself and a set of explanatory variables, using multiple lags. It allows us to identify the determinants of the real average balance in individual retirement accounts. Moreover, the VAR model identifies causality, magnitude and direction of the effect, and the share in the variation that the explanatory variables exert on the dependent variable; the model also identifies the existence of long-run relationship among the variables, and the respond of a variable to an impulse on another variable. Thus, the VAR analysis is an appropriate methodology to achieve the objectives and to test the hypothesis.

The data applied in this study are monthly time series from January 2009 to December 2020, in total there are 144 observations in the sample. The dependent variable is the average balance of individual pension accounts (resacc), in constant Mexican pesos. It is figured out by dividing the resource between the number of individual accounts registered in the retirement saving system through the retirement funds agencies (AFORES), the source is the National Commission for the Retirement Saving System (CONSAR, 2021).

Five explanatory variables are incorporated in the analysis: the economic activity general index (ecoact), it represents economic growth, the source is the National Institute of Statistics and Geography (INEGI, 2021). The jobs registered in the Mexican Institute for the Social Security (IMSS) as a proxy of formal employment (foremp), the source is the Ministry of Employment and Social Provision (STPS, 2021), with information from Cognos. The Mexican stock exchange index (stock), the source is the Mexican Stock Exchange (BMV, 2021). The real average wage in Mexican pesos (avwage) of those registered in the Social Security Mexican Institute, as a proxy of income, the source is (IMSS 2021), with information from Tableau Public. The age dependency ratio (depratio), computed with data from The National Council of Population (CONAPO, 2021).1

Although the pension system of individual accounts started in Mexico in July 1997, the data sample is not taken from this year because the stabilisation of movements from the distribution system to the system of individual accounts took several years. In 1997 there was a mixture of two systems, at the time the employees could select between the two of them, and hence, taking the sample from this period could create bias in the analysis. In the public sector the new system started in 2007, and the employees could decide remaining in the previous system or changing to the new system up to august 2008 (Ordóñez-Barba and Ramírez-Sanchez, 2018). In this context, we take the sample from January 2009 to December 2020 to obtain a more stable period, in terms of the composition of accounts in the pension system, and to have a sample with whole calendar years. In addition, the early months of 2021 are excluded from the sample because in this year the law changed in terms of the composition of the contributions. Table 1 presents descriptive statistics of the variables and Figure 1 shows their graphs.

Table 1 Descriptive statistics of the variables

| Variable | Obs. | Mean | Std. Dev | Minimum | Maximum |

|---|---|---|---|---|---|

| Resacc | 144 | 80,212.95 | 5,723.33 | 63,394.23 | 93,813.82 |

| Ecoact | 144 | 102.48 | 8.73 | 81.84 | 117.77 |

| Stock | 144 | 40,580.38 | 6,670.72 | 17,752.18 | 51,210.48 |

| avwage | 144 | 381.73 | 11.87 | 363.54 | 419.97 |

| depratio | 144 | 0.5284 | 0.0191 | 0.5023 | 0.5630 |

| Foremp | 144 | 17,400,000 | 2,164,805 | 13,900,000 | 20,800,000 |

Source: Own computation with information from CONSAR (2021), INEGI (2021), STPS (2021), BMV (2021), IMSS (2021), and CONAPO (2021).

Source: Own computation with information from CONSAR (2021), INEGI (2021), STPS (2021), BMV (2021), IMSS (2021), and CONAPO (2021).

Figure 1 Graphs of the variables

The analysis starts by conducting unit root tests in the variables so as to determine if they are stationary at levels I(0) or after being differenced I(1). Variables with the same order of integration, for instance I(0) or I(1) can be cointegrated and have a log-run relationship, which avoids spurious coefficients and allows to perform more accurate predictions and interpretations of the data. To test the presence of a unit root in the variables we perform the Augmented Dickey-Fuller tests, all the variables are stationary at levels, that is, they are integrated of order (0), and do not follow a unit root process.

From Figure 1, all the variables seem to have a linear trend, except stock, which resembles a quadratic pattern in the form of inverted U-curve; in fact, the unit root test on the stock variable performs better without a trend. The unit root test on resacc, ecoact and avwage improves with a trend, but it doesn´t on the variables on foremp and depratio; it should be added that in these two variables the test required 12 and 11 lags respectively. Table 2 shows the results and the specification of the test for every variable. The test rejects the null hypothesis that X t is I(1), there is a unit root, in favour of the alternative that X t is I(0), with a confidence of 99 percent in all variables, except for resacc, in which the null hypothesis is rejected with a confidence of 95 percent.

Table 2 Augmented Dickey-Fuller tests on the variables

| Variable | lags | Constant | trend | Test statistic | p-value |

|---|---|---|---|---|---|

| Resacc | 2 | X | X | -3.728 | (0.021) |

| Ecoact | 1 | X | X | -4.409 | (0.002) |

| Foremp | 12 | X | -3.622 | (0.005) | |

| Stock | 2 | X | -3.574 | (0.006) | |

| Avwage | 1 | X | X | -4.846 | (0.000) |

| Depratio | 11 | X | -167.065 | (0.000) |

Source: Own computation.

Since all the variables are stationary in levels I(0) with a confidence of 99 and 95 percent, it is likely that they are cointegrated and have a long-run relationship. To test this statement, we regress the long-run equation (1) and perform the Engle-Granger (1987) cointegration tests. Results are reported in Table 3.

Table 3 Long-run equation and cointegration test

| Variable | Coefficient | p-value |

|---|---|---|

| Ecoact | 136.29** | 0.037 |

| Stock | 0.2580* | 0.000 |

| Avwage | 202.99* | 0.000 |

| Foremp | -0.0015** | 0.017 |

| Depratio | -219,097* | 0.008 |

| Constant | 119,893◆ | 0.065 |

| R2 | 0.847 | |

| Cointegration test statistic | -4.406* |

Source: Own computation.

Notes: Dependent variable is average balance on the retirement accounts (resacc).

*Statistically significant at 99 percent, **Statistically significant at 95 percent, (Statistically significant at 90 percent.

All the coefficients enter the long-run equation with conventional levels of statistical significance. Economic activity, stock market, and real average wage have a positive relationship with average balance in retirement accounts. Formal employment and the dependency ratio have a negative relationship with the dependent variable.2 From the results of the equation in levels, the long-run and cointegrating equation we use for the analysis is:

We know develop the VAR model; the first step is to identify the appropriate lag length; to do so, we compute a variety of test statistics for multiple VARs of varying lag length. Table 4 reports the statistics of the likelihood-ratio test (LRT), and four information criteria -Akaike´s final prediction error (FPE), Akaike (AIC), Hannan and Quinn (HQIC), and Schwarz´s Bayesian (SBIC). The LRT, FPE, AIC and HQIC prefer five lags, and the SBIC choose two lags, we use five lags to match four out of five tests. The VAR model to estimate is presented in Equation (3).

Table 4 Test statistics for the identification of lag length on the VAR model

| lag | LL | LRT | LRT (p) | FPE | AIC | HQIC | SBIC |

|---|---|---|---|---|---|---|---|

| 0 | -5,007.36 | 8.60E+23 | 72.13 | 72.19 | 72.26 | ||

| 1 | -4,131.74 | 1751.2 | 0.000 | 4.90E+18 | 60.05 | 60.41 | 60.94 |

| 2 | -4,001.42 | 260.65 | 0.000 | 1.30E+18 | 58.70 | 59.37 | 60.34* |

| 3 | -3,929.19 | 144.46 | 0.000 | 7.50E+17 | 58.18 | 59.15 | 60.58 |

| 4 | -3,862.68 | 133.01 | 0.000 | 4.90E+17 | 57.74 | 59.02 | 60.90 |

| 5 | -3,765.25 | 194.87* | 0.000 | 2.10e+17* | 56.85* | 58.44* | 60.78 |

Source: Own computation

Notes: * The smallest figure in the five lags options

Endogenous: resacc ecoact stock avwage foremp depratio. Exogenous: constant

Before we move on obtaining additional information from the VAR model, some relevant tests are performed.

Table 5 provides the results of testing Granger causality from the explanatory variables to the average balance in the retirement accounts; it is possible to observe that there is causality from four explanatory variables (stock, avwage, foremp, depratio) towards resacc. There is also Granger causality in the resacc equation when the test is conducted for the whole equation. Only economic activity does not present granger causality towards the dependent variable; however, from the results of the test in the other equations it is possible to observe that there is granger causality from economic activity to real average wage and formal employment, indicating that the economic activity impacts resacc indirectly through employment and wage.

Table 5 Granger causality test

| Excluded variables | chi2 | DF | p value |

|---|---|---|---|

| Ecoact | 5.0535 | 5 | 0.409 |

| Stock | 9.3831 | 5 | 0.095 |

| Avwage | 12.825 | 5 | 0.025 |

| Foremp | 20.962 | 5 | 0.001 |

| Depratio | 15.619 | 5 | 0.008 |

| All variables | 91.231 | 25 | 0.000 |

Source: Own computation

Notes: Equation: Average balance on the retirement accounts.

H0: there is no Granger causality

A VAR process is stationary if all the eigenvalues of the companion matrix lie inside the unit circle; we test the stationarity of the model by conducting an eigenvalue stability condition tests,3 all the eigenvalues lie inside the unit circle, the VAR satisfies stability conditions, it is stationary and stable, the results are presented in Table 6, due to the extension of the output we present the first 7 eigenvalues, the others have decreasing values up to 0.441. The analysis assumes that the VAR disturbance are normally distributed, hence, the Jarque-Bera test is available; in the model, the null hypothesis of normal disturbance is rejected for the economic activity and dependency ratio equations, and it is not rejected for the other equations, including average balance per retirement account, which is the equation of interest (Table 7). The analysis also assumes that there is no residual autocorrelation; in this respect, a Lagrange-multiplier test, with a null hypothesis of no residual autocorrelation, up to 3 lags is performed, the test does not indicate evidence of autocorrelation at any lag order (Table 8).

Table 6 Eigen value stability condition

| Eigenvalue | Modulus | ||

|---|---|---|---|

| 0.99309 | 0.99309 | ||

| 0.96978 | + | .07504 | 0.97268 |

| 0.96978 | - | .07504 | 0.97268 |

| 0.82811 | + | .49757 | 0.96610 |

| 0.82811 | - | .49757 | 0.96610 |

| 0.46783 | + | .83693 | 0.95882 |

| 0.46783 | - | .83693 | 0.95882 |

Source: Own estimations.

Table 7 Jarque-Bera tests

| Equation | Prob |

|---|---|

| resacc | 0.273 |

| ecoact | 0.000 |

| stock | 0.157 |

| avwage | 0.607 |

| depratio | 0.000 |

| foremp | 0.828 |

Note: H0: normal disturbance

Table 8 Lagrange-multiplier test

| Lag | Prob |

|---|---|

| 1 | 0.109 |

| 2 | 0.444 |

| 3 | 0.173 |

Note: H0: no autocorrelation at lag order

The VAR model satisfies the tests of stability and autocorrelation, the test of normality and causality are satisfied in the resacc equation. In this context, we proceed to perform the analyses of impulse-response function (IRF) and forecast error variance decomposition (FEVD), with emphasis on the variable of interest, average balance per retirement account.

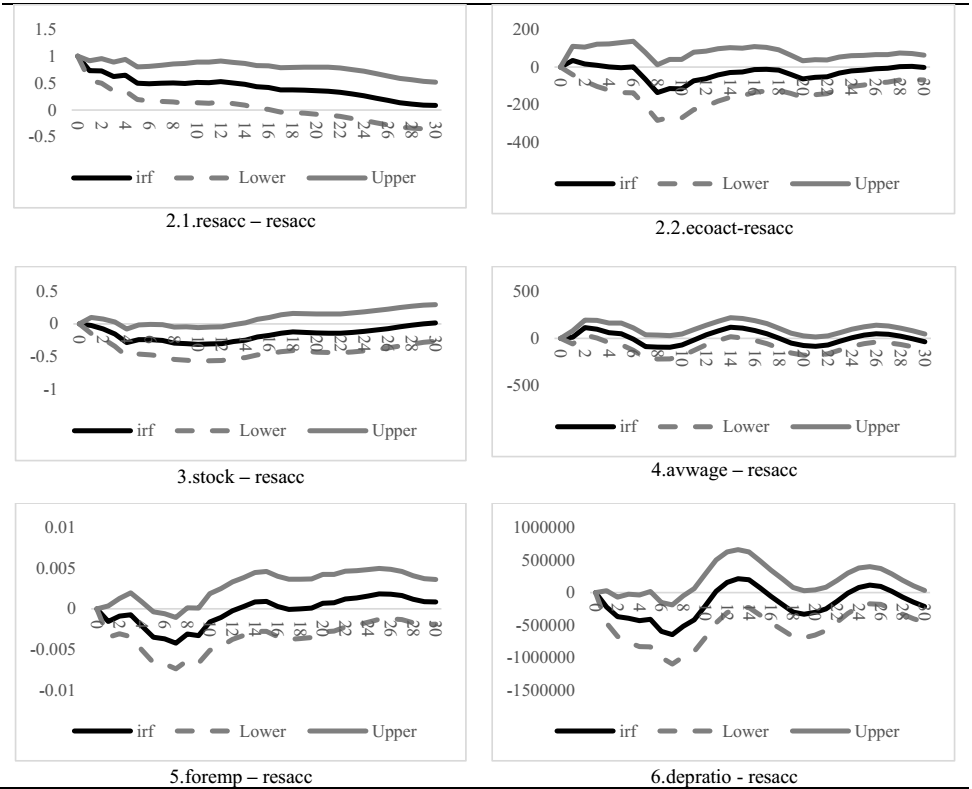

An IRF measures the effect of a unit shock to an endogenous variable on itself or on another endogenous variable over time, it shows the effects of the shocks in magnitude and sign and the adjustment path of the variables. Figure 2 presents, the response on the dependent variable (resacc) to an impulse on the explanatory variables and on itself over 30 periods or months, reporting the IRF and the 95 percent lower and upper bounds.

Source: Own computation

Figure 2 Impulse on explanatory variables and response on average balance of retirement accounts functions

The respond on the real average balance on retirement accounts to an impulse on the variables in the system is commented as follows: on itself is positive, then it decreases gradually, after period 36 it stabilises around cero in the longer-run (Figure 2.1). On the economic activity is positive in the early periods, after period six it turns negative, but after period 34 the respond becomes positive and remains so in the longer-run (Figure 2.2). On the stock market is negative up to the period 28, then the impact becomes positive and growing in the longer-run (Figure 2.3). On real average wage oscillates around cero, but is mostly positive, in the long run after period 40 it stabilises positive and close to cero (Figure 2.4). On former employment is negative in early periods, after period 12 becomes positive, in the longer run it turns negative (Figure 2.5). On the dependency ratio oscillates around cero, but it is mostly negative, over the longer-run stabilises negative (Figure 2.6). In this context, the IRF analysis is consistent with the sign of the long-run effects reported in the cointegrated Equation (1) and Table 3.

We now perform the FEVD analysis, it measures the contribution of each shock to the forecast error variance (Pesaran and Shin, 1998). It provides information about the percentage of variation in a variable due to its own shock and due to shocks to other variables in the system (Tang, et al., 2020). The outcome for the resacc equation is reported in Table 9 in selected months over a 30 periods horizon.

Table 9 Results on variance decomposition for the average balance on retirement accounts

| Horizon | Resacc | Ecoact | Stock | avwage | foremp | depratio |

|---|---|---|---|---|---|---|

| 1 | 100.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2 | 97.28 | 0.08 | 0.40 | 0.50 | 0.92 | 0.79 |

| 6 | 64.39 | 3.00 | 16.70 | 7.60 | 2.85 | 5.47 |

| 14 | 44.89 | 11.72 | 26.30 | 4.43 | 5.38 | 7.28 |

| 22 | 44.53 | 10.08 | 27.73 | 4.98 | 4.53 | 8.15 |

| 30 | 44.47 | 9.70 | 27.46 | 5.00 | 5.23 | 8.14 |

Source: Own computation

Most of the variation in FEVD of the resacc is explained by its own shock in the short-run, and it decreases to 44.47 percent over the long-run in period 30, but remains the largest contribution, out of all determinants. The other determinants of the dependent variable show negligible contributions in the early periods, but the contributions increase gradually over the long-run. The largest contribution, apart from the resacc, comes from the stock market, it explains 27.46 percent of variations in the dependent variable in the last period in the table. Then, it is followed by the economic activity and the dependency ratio, in the long run, over the 30th period, they explain 9.70 and 8.14 percent of the variation in resacc respectively. The lowest contributions come from the formal employment and the real average wage, with 5.23 and 5.00 percent respectively.

IV. Comments on the results

Overall, the analysis illustrates that the stock market is a robust an influential variable with positive effect and suggests that institutional pension funds investors have sophisticated their investment methods in the stock market and have managed to gain benefits for the retirement account holders. However, the results indicate that investment of pension funds in the stock market should be long-term investment if it is to deliver benefits. From the impulse-response function, it is possible to observe that the positive effect the stock market arises by the month 29. The results satisfy the hypothesis and are consistent with the literature pointing out a positive influence of the variable on pension funds (Bayar, 2016, Babalos and Stavroyiannis, 2020).

The real average wage holds a statistically significant, positive, and elastic effect in the long-run analyses. The results are in keeping with previous studies (Fernández, et al., 2015, Torricelli, et al., 2016) and with the hypothesis of the study. Nevertheless, in the longer run, the share of the real average wage in variations of the dependent variable is the lowest out of the set of variables. In this context, there is evidence of strong correlation between the real wage and the dependent variable, but the magnitude of the effect is small in relation to other variables, as pointed out by the FEVD analysis. This finding can be explained, because the real average wage in México has remained steady over the last decades, and this fact diminishes the impact the variable can have in retirement savings.

The dependency ratio effect is negative, statistically significant and elastic in the long-run analyses. The outcome is in line with previous studies applying the age dependency ratio or proxies of age (Wong and Ki Tang, 2013, Horioka and Tereda-Hagiwara, 2016, Niznik and Owziak, 2020), and is consistent with the life-cycle hypothesis and our hypothesis. Hence, one of the determinants of improvement in the average retirement savings is the increase of the proportion of the economically active population in relation to the whole population and the ageing of this population segment. In this respect, it is important the universalisation of the possession of individual retirement accounts and that contributions to retirement saving account be continuous to achieve benefits along the time. If the contribution is intermittent, due to the instability of the labour market, the benefits of ageing diminish.

Employment exerts a statistically significant and negative effect on the variable of study. This result is consistent with the argument that new jobs created by economic growth might be low pay jobs, or jobs for young people who are new enters in the pension system with no previous saving in their retirement accounts, which causes a reduction of the average balance, and is also consistent with the hypothesis. The related studies approximating more our results are those analysing the equity allocation of new participants in the pension system and showing that youngers take more risk to attempt to improve their low balance and contribution in their accounts, relative to all participants (Benartzi and Thaler, 2007, Clark and Mitchell, 2020), these studies confirm that new jobs creation tend to reduce the average balance in the pension accounts.

The economic activity is statistically significant and positively associated to average balance in retirement accounts. What is striking is that there is no evidence of causality from employment to resacc. But as commented in section 3, there is causality from economic activity to average wage and to employment, and therefore, the effect of the economic activity on resacc is transmitted through these two variables. The positive effect of average wage is dominant because the effect of economic activity on the average balance of retirement accounts takes its positive sign and does not take the negative sign from employment.

The scope of the paper comprises analysis of correlation and causality, besides the study of the long-term impact, contribution, and pattern of the variables, from a time-series and macroeconomic perspective. On the contrary, the limitation of the study is that it is constrained to the formal sector and does not involve microlevel data.

Conclusions

The application of a VAR model and the analyses derived from it, such as the Granger causality test, the impulse-response function and the factor error variance decomposition have allowed the study to identify five determinants of the average balance in the retirements saving accounts, they are stock market, real average wage, age dependency ratio, and employment; the economic activity determines the variable of study through real average wage and employment. In this context the first objective of the study is fulfilled.

The analysis has also identified the following points: There is long-run relationship between the average balance in retirement saving accounts and its determinants; the variables that improve the individual retirement saving are average wage, stock market, and economic activity. The age dependency ratio and employment diminish the dependent variable. The response of the individual retirement saving to the impulse of the determinants can take cyclical patterns or diverse directions, but over the long run the response is in keeping with the signs obtained in the cointegrated equation. The variable that explains more the variations in average saving in retirement accounts in the long-run is the stock market, followed by the economic activity and the dependency ratio, and in turn followed by formal employment and the average wage. In this respect, we have identified the pattern of the effect that the determinants exert on the dependent variable and hence, the second objective is also satisfied.

Our results are consistent with most of the theoretical arguments discussed in the study and are also in keeping with the hypothesis formulated.

Many studies have argued that the problem of lack of income during old age in Mexico is found within the current pension system itself. Ramirez (2019) points out deficient coverage and benefits, and fiscal unsustainability of the system as the main causes. Clavellina Miller (2020) indicates that the parameters of the system associated to factors such as contributions, retirement ages, voluntary saving, fees, and benefits determine replacement rate and dignified retirement of the future pensioners. Morales Ramírez (2020) underlines the fragmentation, heterogeneity, limited coverage, and fiscal burden of the pension system as the causes of inequality and exclusion in the retirement age. All these studies stress the need for a reform in the pension system to dignify retirement and improve income of the elderly.

We acknowledge that the current defined contribution system in Mexico has room for improvement and requires innovative reforms to deliver better conditions for the pensioners. However, improvement of the system does not depend only on factors of the system itself. In this context, the main contribution of the paper is to identify age dependency and macroeconomic variables as determinants of saving in individual retirement accounts, besides the magnitude, direction, and trend of the determinants' effect. The paper also contributes to provides a different perspective to the current relevant literature and offers room for alternative strategies to improve the system and individual retirement conditions. With the evidence obtained in the study we are in the position to formulate the following policy suggestions:

Pension funds should be invested in the stock market in a long-term horizon, two and a half years or more. We suggest investing on key and emerging economic sectors, those with the capacity to drive economic growth and well-paid jobs and conducting investment through sound and diversified portfolios (Centeno-Cruz, et al., 2019). This policy should be aimed at reducing the risk and increase the rate of return of the investment; as well as fostering economic growth and the quality of employment, under the understanding that these two variables are also macroeconomic determinants of retirement saving, which have been found in the study.

The real average wage should be boost, by increasing minimum wage and by providing incentives to those firms adopting a policy of certified well-paid jobs. It is also important to encourage the rise of labour productivity through incentives to those employers achieving predefined targets, and to keep inflation in check. In this respect, the era of low-wage competitive advantage must be replaced by the era of productive and well-paid jobs to foster internal demand and saving.

The creation of jobs must be strengthened in industries with high productivity, innovation, and skill intensive, where jobs are formal, and wages are higher. In addition, family firms, small firms, and labour-intensive economic activities such as primary sectors and low skill manufacture, must be fostered through cooperatives and strategic associations to take advantage of economies of scale; they also should be incorporated in training and formalisation programs. These actions should be aimed at encouraging the creation of formal and well-paid jobs, so that the employees enter the pension system in better conditions and with more contributions to their pension accounts.

Priority should be given to long-term and permanent jobs, formalisation of employment, and stability of the labour market, to guarantee permanent contributions to the individual retirement accounts. A scheme of individual, unique, and universal retirement accounts can be undertaken, in which saving comes from voluntary or public contributions for those unemployed or excluded from the formal labour market. In these circumstances, the aging of the economically active population does not act against retirement saving, on the contrary, benefits and enhances it. Moreover, those in need build their pension along life and do not have to rely on assistance programmes during the retirement age.

Under the macroeconomic scheme above, economic activity improves real average wage and employment conditions, and transmits benefits to individual retirement saving through these two variables. Moreover, institutional retirement investment in the stock market enhances saving, which boosts the economy, while the aging of the economically active population works in favour of individual retirement saving. In this context, universality and dignification of the retirement saving not only relies on pension system reforms, which could involve changes in the parameters of the system that eventually might transform it in to one fiscally unsustainable, with affectations to the employers’ feasibility, but also relies on the improvement of macroeconomic conditions.

nueva página del texto (beta)

nueva página del texto (beta)